Analyst Ratings and Recommendations for Johnson & Johnson

JNJ stock has risen 27.9% in the last 12 months. Analysts estimate that the stock could rise 1.4% over the next 12 months.

Jan. 22 2018, Updated 10:32 a.m. ET

Wall Street analysts’ estimates

Johnson & Johnson’s (JNJ) reported revenues were $19.7 billion in 3Q17, which was a 10.3% growth compared to 3Q16. Wall Street analysts are estimating that Johnson & Johnson will generate EPS (earnings per share) of $1.72 on revenues of $20.1 billion in 4Q17, a 10.9% growth compared to 4Q16, due to the increase in sales across all three of its segments.

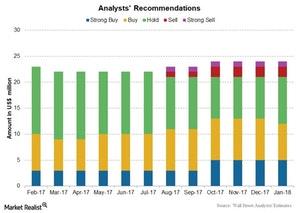

The above chart shows analysts’ recommendations over the past 12 months. For 2017, analysts estimate EPS of $7.28 on revenues of $76.3 billion, a 6.2% growth compared to 2016.

Analyst ratings

JNJ stock has risen 27.9% in the last 12 months. Analysts estimate that the stock could rise 1.4% over the next 12 months. Analyst recommendations show a 12-month target price of $148.36 per share compared to the last price of $146.98 on January 17, 2018.

As of January 18, 2018, there are 24 analysts tracking Johnson & Johnson. Twelve of them have recommended a “buy” for the stock, and nine have recommended a “hold.” Three analysts have recommended a “sell.” The consensus rating for Johnson & Johnson stands at 2.5, which represents a moderate “buy” for value investors. Changes in analysts’ estimates and recommendations are based on the changing trends in the price of a stock and the performance of a company.

The iShares Global 100 (IOO) holds 12.4% of its total investments in healthcare companies. It has 3.1% of its total investments in Johnson & Johnson (JNJ), 1.8% in Novartis AG (NVS), 1.7% in Pfizer (PFE), and 1.3% in Merck & Co. (MRK).