A Look at Merck’s Diabetes and Women’s Health Business

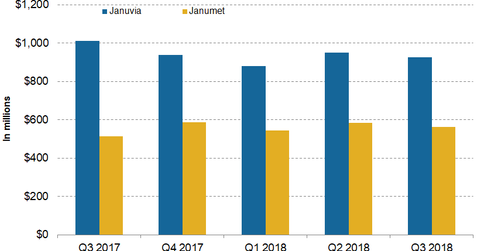

Merck & Co.’s (MRK) Januvia generated revenues of $927 million in the third quarter, reflecting an ~8% YoY (year-over-year) decline.

Nov. 2 2018, Updated 10:30 a.m. ET

Diabetes segment’s revenue trends

Merck & Co.’s (MRK) Januvia generated revenues of $927 million in the third quarter, reflecting an ~8% YoY (year-over-year) decline. In the US and international markets, Januvia generated revenues of $498 million and $429 million, respectively, reflecting a ~17% YoY decline and a ~45 YoY growth.

Januvia generated net revenues of $2.8 billion for the first nine months of the year, reflecting a ~2% YoY decline.

Merck’s Janumet generated revenues of $563 million in the third quarter, reflecting a ~10% YoY growth. In the US and international markets, Janumet generated net revenues of $225 million and $339 million, respectively, in the third quarter, reflecting a ~14% YoY growth and a ~75% YoY growth, respectively.

Janumet generated net year-to-date revenues of $1.7 billion, which was an ~8% YoY growth.

In the marketplace, Januvia’s and Janumet’s peer drugs include Eli Lilly’s (LLY) Trajenta, AstraZeneca’s (AZN) Onglyza, and Novartis’s (NVS) Galvus. In the third quarter, Galvus generated revenues of $307 million, reflecting a ~1% YoY decline.

Women’s Health revenue trends

Merck’s NuvaRing generated revenues of $234 million in the third quarter, reflecting a ~9% YoY growth. NuvaRing reported net revenues of $193 million and $41 million from US and international sales, respectively, reflecting a ~21% YoY growth and a ~25% YoY decline, respectively.

NuvaRing reported net year-to-date revenues of $686 million, a ~20% YoY growth.

Implanon/Nexplanon generated revenues of $186 million in the third quarter, reflecting a ~20% YoY growth. Implanon/Nexplanon reported year-to-date net revenues of $535 million, reflecting a ~6% YoY growth.

In the US and international markets, Implanon/Nexplanon generated revenues of $133 million and $53 million, respectively, reflecting a ~21% YoY growth and a ~19% YoY growth, respectively.

Revenue growth for Merck’s Women’s Health segment could significantly contribute to the company’s revenue growth, which, in turn, could boost the share prices of the Invesco Dynamic Pharmaceuticals ETF (PJP). Merck makes up ~5.86% of PJP’s total portfolio holdings.