Can Alcoa Generate Positive Free Cash Flows in 2016?

Alcoa (AA) generated free cash flows of $55 million in 2Q16—compared to $205 million in the same quarter last year.

Aug. 9 2016, Updated 11:07 a.m. ET

Positive free cash flows

Previously, we looked at aluminum producers’ 2Q16 earnings. However, looking at the current challenging situation, the market (DIA) is more interested in cash flows.

Generating negative free cash flow could lead to cash burn. As a result, companies might have to borrow to fund their deficits. Negative free cash flow will only make things worse in the current market scenario.

Century Aluminum

Century Aluminum (CENX) generated free cash flows of $3 million in 2Q16. In comparison, the company generated free cash flows of $11 million in 1Q16 and -$63 million in 2Q15. Note that Century Aluminum’s 2Q16 cash flows aren’t strictly comparable to the previous quarters. The company made a payment of $38 million towards the Mt. Holly acquisition in 2Q15. It received an earn-out of $13 million from the same transaction in 1Q16.

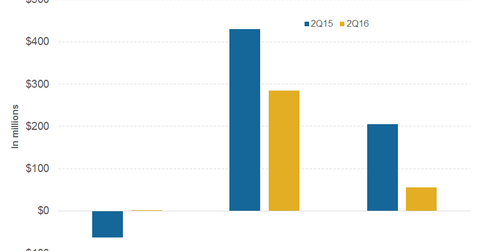

Norsk Hydro (NHYDY) also generated free cash flows of $285 million in 2Q16—compared to free cash flows of $430 million in the sa,e quarter last year. Rio Tinto’s (RIO) aluminum group generated operating cash flows of $1 billion in 1H16.

Alcoa’s cash flows

Alcoa (AA) generated free cash flows of $55 million in 2Q16—compared to $205 million in the same quarter last year. Alcoa has generated negative fee cash flows of $626 million in 1H16. Note that the cash flows are for the consolidated company which includes both the upstream and downstream business.

Alcoa usually provides an annual cash flow guidance. However, the company refrained from giving an annual guidance for fiscal 2016 due to volatility in commodity markets (COMT) and separation costs associated with its split.

Note that Alcoa could still end up posting positive free cash flows in fiscal 2016. The company usually generates a lot of cash in the fourth quarter due to seasonal working capital reduction.

In the next part of the series, we’ll see what different aluminum producers had to say about the industry outlook during their respective 2Q16 earning calls.