Analysts Are Optimistic about Coeur Mining

Market sentiment for Coeur Mining Coeur Mining (CDE) is a high-cost producer compared with peers (RING) (SIL). While it has initiated several measures to bring down its costs in the last few years, they remain high. Higher costs make CDE more leveraged to gold and silver prices than other low-cost producers such as Barrick Gold (ABX) […]

Nov. 20 2020, Updated 4:37 p.m. ET

Market sentiment for Coeur Mining

Coeur Mining (CDE) is a high-cost producer compared with peers (RING) (SIL). While it has initiated several measures to bring down its costs in the last few years, they remain high. Higher costs make CDE more leveraged to gold and silver prices than other low-cost producers such as Barrick Gold (ABX) and Newmont Mining (NEM).

Coeur released its 2Q17 production results on July 6, 2017, which were slightly below market expectations. Coeur Mining also downgraded its 2017 production guidance slightly, to reflect the following:

- higher expected gold production at the Wharf mine

- lower expected silver (AGQ) production at the San Bartolomé mine

- a pending agreement to sell the Endeavor silver stream

Analyst recommendations

Among primary silver producers, Coeur Mining has the most “buy” recommendations, from 71% of analysts. Another 29% recommend “hold” for the stock, and there were no “sell” recommendations.

The average target price for CDE is $11.46, compared with its current market price of $8.78, implying an upside potential of 30.5%. Analysts have downgraded their target price by 11% since the start of the year. This downgrade is in line with the stock’s fall year-to-date.

Analyst estimates

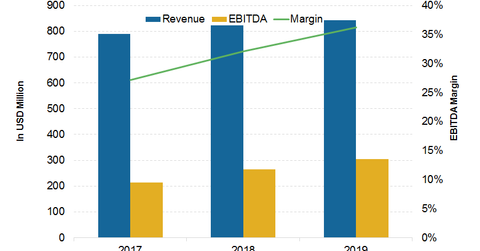

According to Thomson Reuters data, Coeur Mining (CDE) is expected to have revenue of $178.5 million in 2Q17 and $788.4 million in fiscal 2017. The revenue projection for fiscal 2017 implies a rise of 18.4% YoY (year-over-year). Coeur’s actual revenue rose 3% YoY in 2016. The expected rise in 2017 is due to Coeur’s guidance for a production increase of 9% at the midpoint. For a detailed analysis of Coeur’s 1Q17 performance, read Will Coeur Outperform Mining Peers in 2017?

While analysts expect Coeur’s revenue to head higher in 2017, its EBITDA (earnings before interest, tax, depreciation, and amortization) are estimated to fall slightly. The consensus expectation for EBITDA is $213.8 million in 2017, implying a fall of 0.6% annually. This drop is despite an expected revenue increase, mainly because of higher cost expectations for the miner in 2017. Coeur has guided for higher costs at its Wharf mine. In line with its fall in EBITDA, Coeur’s margin projection for 2017 is 27.1%, compared with 32.3% in 2016. Going forward, costs should decline as Wharf enters the high-grade area and Palmarejo’s production ramps up. Analysts expect a margin of 32.1% in 2018 and 36.3% in 2019. In the next part, we’ll look at analysts’ expectations for Tahoe Resources (TAHO).