The Benefits of Real Asset Investing

In essence one of the things we have accomplished with these three products is to reduce the volatility inherent in all markets, and in particular very volatile markets like the real asset sectors.

Nov. 20 2020, Updated 2:20 p.m. ET

VanEck

MORRIS: In essence one of the things we have accomplished with these three products is to reduce the volatility inherent in all markets, and in particular very volatile markets like the real asset sectors. It’s another way, in a sense, for investors, by keeping those profits through the cycle, they can actually compound their money in a slightly different way as opposed to a buy-and-hold strategy for long periods of time. This way they can keep their profits and compound in that fashion.

SCHASSLER: That’s exactly right.

MORRIS: Excellent. Interesting that we’ve moved into this area at VanEck. In some ways this is kind of a marriage of our fundamental investing, long-only investing heritage, particularly in emerging markets and global markets and natural resources. And we’re sort of marrying that with some of the stuff your group is doing in quantitative analysis. Is that another way to look at it?

SCHASSLER: I think that that’s right. Each idea that we put into these portfolios, these models, is based off a fundamental underpinning.

MORRIS: Wonderful. Well, I think this has been a very interesting discussion. I really enjoy some of these new products we’re developing. I think they’re going to be very important for investors, particularly as we enter a period where really asset prices are fair or overvalued in many sectors. And I think this risk-managed solution could be very important for investors.

SCHASSLER: Thank you, Roland.

MORRIS: Thank you for spending time with us today. For further information, please visit VanEck’s website, vaneck.com. There’s information about these Guided Allocation products as well as many other investment products that we provide to investors globally. Thank you.

Market Realist

Stock market volatility opens the door for real assets

As we discussed in the previous parts of this series, the stock and bond markets have showed tremendous growth since the US election, especially last year. However, this year, the market has been extremely volatile—and expectations suggest that volatility could still further rise. J.P. Morgan, in “Global Fixed Income Views: Q3 2018,” mentioned that it believes volatility across the markets is likely to increase as the market transitions from quantitative easing to quantitative tightening.

When the stock and bond markets become volatile, they open the door for another asset class: real assets. Real assets are the broader range of tangible and intangible hard assets like precious metals, commodities, real estate (VNQ), natural resources, and infrastructure (IGF).

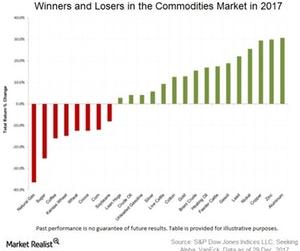

Investing in real assets helps investors protect their portfolio during market downturns. Commodities (DBC)(PDBC) have been bouncing back since 2016. The chart above shows the winners and losers in the commodities market in 2017. Gold is already considered a safe-haven asset since it has a low-to-negative correlation with other asset classes and generally benefits during geopolitical crises and volatile markets. Oil prices are also expected not to suffer anymore and to level at $67 per barrel at the end of 2018.

Providing exposure to real assets, VanEck offers the VanEck Vectors Real Asset Allocation ETF to generate long-term returns.

It goes without saying that, since every asset class carries some amount of risk, investors should carefully consider and fully understand the risks and rewards before making any investment decisions.