PowerShares DB Optm Yd Dvrs Cdty Srt ETF

Latest PowerShares DB Optm Yd Dvrs Cdty Srt ETF News and Updates

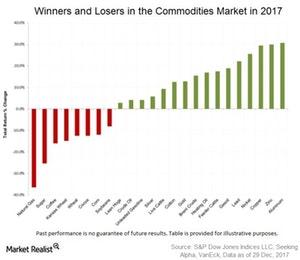

The Benefits of Real Asset Investing

In essence one of the things we have accomplished with these three products is to reduce the volatility inherent in all markets, and in particular very volatile markets like the real asset sectors.

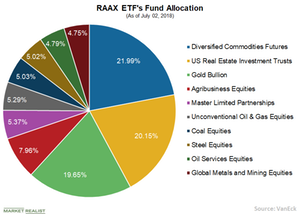

RAAX ETF: Capturing Real Benefits of Real Assets

RAAX’s allocation process provides exposure to segments with better returns profiles while managing overall portfolio risk.