iShares Global Infrastructure

Latest iShares Global Infrastructure News and Updates

The Benefits of Real Asset Investing

In essence one of the things we have accomplished with these three products is to reduce the volatility inherent in all markets, and in particular very volatile markets like the real asset sectors.

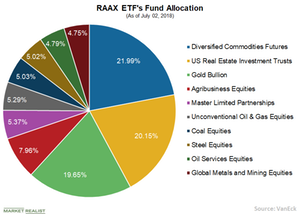

RAAX ETF: Capturing Real Benefits of Real Assets

RAAX’s allocation process provides exposure to segments with better returns profiles while managing overall portfolio risk.

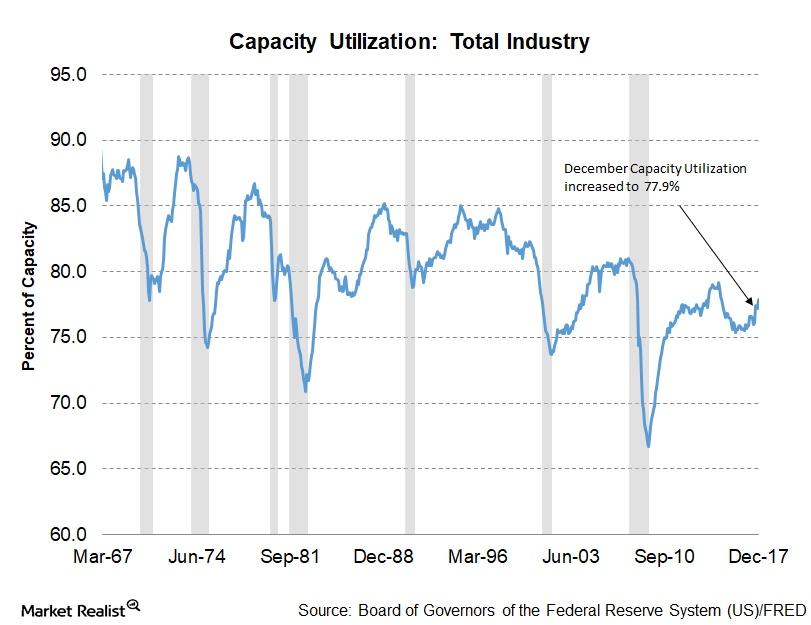

Capacity Utilization Trends across US Industries in December

Capacity utilization and the US economy Among the key macroeconomic indicators published by the Federal Reserve, US industries’ capacity utilization is particularly important for understanding the health of each industry. Changes to this indicator can help forecast any changes to the business cycle, product demand, and workforce demand. Increasing levels of capacity utilization could translate to a higher number […]

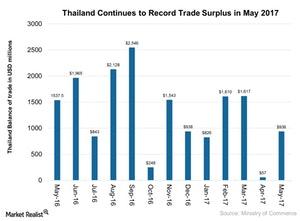

Why Thailand’s Trade Surplus Rose in June 2017

Thailand’s trade balance continues to expand due to improvement in external demand and tourism in May 2017.

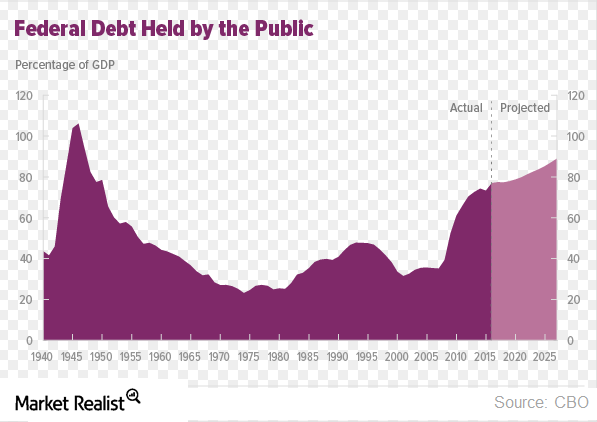

Will Congress Reset Debt Levels?

The CBO expects the budget deficit to remain below 3% of GDP until 2019.

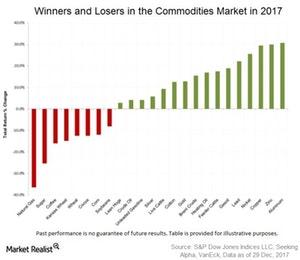

Goldman Sachs Gets Bullish on Commodity Prices

Goldman Sachs has gone bullish on commodities. The finance major, which is the biggest commodities dealer (in sales), has advised clients to go overweight.