How Bunge Returns Value to Shareholders

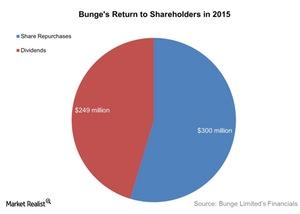

Bunge (BG) paid $549 million to shareholders through dividends and share repurchases in 2015.

June 21 2016, Updated 4:30 p.m. ET

Increasing dividends

Bunge (BG) paid $549 million to shareholders through dividends and share repurchases in 2015. The company paid $249 million as dividends in 2015. Bunge has a dividend yield of 2.2% as of June 9, 2016. The company’s management raised the dividend at a CAGR (compounded annual growth rate) of 9.6% over the past five years. For 2015, the company gave a total of $1.4 per share to shareholders in the form of dividends.

On May 24, Bunge announced that its Board of Directors had approved a 10.5% increase in the company’s regular quarterly common share cash dividend from $0.38 to $0.42 per share. The increased dividend will be paid on September 2, 2016, to shareholders of record on August 19, 2016.

Along with this, Bunge also declared a quarterly cash dividend of $1.22 per share on its 4.88% cumulative convertible perpetual preference shares. This will be paid on September 1, 2016, to shareholders of record on August 15, 2016. In the first quarter of 2016, Bunge returned $243 million in cash to shareholders through dividends and share repurchases.

Share repurchases

The company purchased a total of $600 million worth of shares in 2014 and 2015. Bunge announced a $500 million share repurchase program in May 2015. In 2016, the company has repurchased $200 million in shares year-to-date. $181 million of this was in the first quarter, and $19 million was in the second quarter.

Peers’ dividend yield

Bunge’s peers in the agribusiness industry include Syngenta (SYT), Ingredion (INGR), and Archer Daniels Midland (ADM). As of June 9, their dividend yields were as follows:

- Syngenta: 2.7%

- Ingredion: 1.5%

- Archer Daniels Midland: 2.7%

The FlexShares Morningstar Global Upstream Natural Resources Index ETF (GUNR) invests 1.4% of its holdings in BG, and the PowerShares DWA Consumer Staples Momentum Portfolio (PSL) invests 2.5% of its holdings in INGR.