FlexShares Global Upstream Natural Resources Index Fund

Latest FlexShares Global Upstream Natural Resources Index Fund News and Updates

Bunge Consistently Returns Value to Shareholders

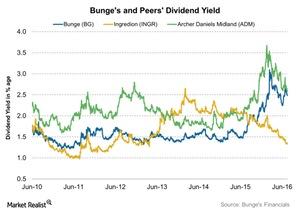

On May 24, Bunge announced that its board of directors approved a 10.5% increase in the company’s regular quarterly common share cash dividend.

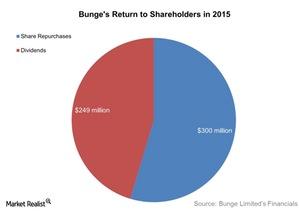

How Bunge Returns Value to Shareholders

Bunge (BG) paid $549 million to shareholders through dividends and share repurchases in 2015.