How Eli Lilly’s Taltz Performed in Clinical Trials

On June 15, 2017, Eli Lilly announced data from a study that evaluated the safety and efficacy of Taltz in patients with active psoriatic arthritis.

June 19 2017, Updated 7:36 a.m. ET

Taltz

Taltz (ixekizumab), a new product from Eli Lilly (LLY), is a monoclonal antibody used for the treatment of plaque psoriasis. On June 15, 2017, Eli Lilly announced data from the SPIRIT-P2 study that evaluated the safety and efficacy of Taltz in patients with active psoriatic arthritis. Eli Lilly also announced the detailed results in an oral presentation at the Annual European Congress of Rheumatology in Madrid.

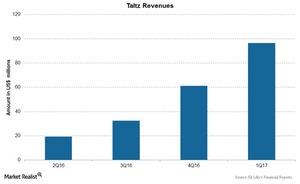

The above chart shows revenues of Taltz over the last few quarters. The drug was launched in the US markets as well as European markets in mid-2016 and reported revenues of $96.6 million in 1Q17 with ~$88 million in revenues from US markets.

SPIRIT-P2

The SPIRIT-P2 study is a multicenter, randomized, double-blind, placebo controlled, 24-week study that evaluates the efficacy and safety of Taltz in patients with active psoriatic arthritis. The study compares the safety and efficacy of 80mg of Taltz every two to four weeks following a 160mg starting dose and placebo after 24 weeks of treatment in previously treated patients with active psoriatic arthritis.

The primary endpoint was that the patient achieves at least a 20% reduction in the composite measure of disease activity, also called “ACR20,” as per the definition from the American College of Rheumatology.

Results of SPIRIT-P2

The 24-week response rate as per dosage was as follows:

- Taltz 80mg every four weeks: 53% of patients reported a 20% reduction in disease (or ACR20), while 35% of patients reported a 50% reduction in disease (or ACR50), and 22% of patients reported a 70% reduction in disease (or ACR70).

- Taltz 80mg every two weeks: 48% of patients reported ACR20, while 33% of patients reported ACR50, and 12% of patients reported ACR70.

- Placebo: 19% of patients reported ACR20, while 5% of patients reported ACR50, and 0% of patients reported ACR70.

Regulatory updates

Eli Lilly has submitted a supplemental biologics license application to the US Food and Drug Administration for the use of Taltz in patients with active psoriatic arthritis. The drug is already approved for active psoriatic arthritis in Japan. The company expects to submit applications in other countries in 2H17.

To divest the risk, investors can consider ETFs like the Fidelity MSCI Healthcare ETF (FHLC), which holds 2.2% of its total assets in Eli Lilly. FHLC also holds 6.7% in Pfizer (PFE), 3.1% in Bristol-Myers Squibb (BMY), and 5.3% in Merck (MRK).