These Factors Are Affecting Gold

Gold, silver, platinum, and palladium have a five-day trailing loss of 0.67%, 0.44%, 1.1%, and 1.5%, respectively.

Oct. 27 2017, Updated 9:04 a.m. ET

DXY rebounded

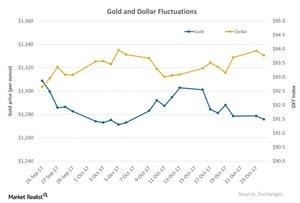

All four precious metals dropped in the past week. Gold, silver, platinum, and palladium have a five-day trailing loss of 0.67%, 0.44%, 1.1%, and 1.5%, respectively. The fall in these metals most likely came from the recovery in the US dollar. In the image below, the US dollar is depicted by the DXY Currency Index, which prices the dollar against a basket of six major world currencies. The DXY has risen 0.28% on a five-day trailing basis. On a 30-day trailing basis, it has risen 1.7%.

Fed doldrums

On Monday, Donald Trump dismissed the possibility of curbing a popular tax-deferred US retirement savings program. Trump also said that he is quite close to appointing the next chair of the Federal Reserve. The Fed will likely increase interest rates in December and then twice in the next year.

Precious metals, which are dollar-denominated assets (UUP), are falling due to the increase in the dollar. Also, as gold (IAU) and silver (SLV) do not bear any intermediary cash flows, they may further deteriorate with an increase in interest rates.

The rising risk in the market like tensions in North Korea may also be beneficial for these haven assets. The rise in these safety assets also boosts mining stocks and funds. Some of the miners that saw an up day on Tuesday are Harmony Gold (HMY), Alacer Gold (ASR), Aurico Gold (AUQ), and Sibanye Gold (SBGL).