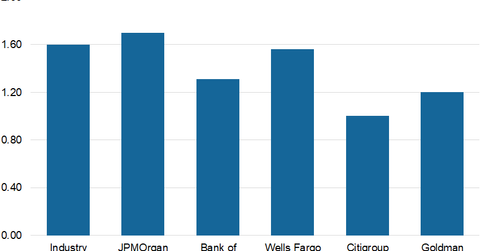

A Look at the Top Five US Banks’ Valuations

On a TTM basis, JPMorgan Chase trades at a price-to-book ratio of 1.7x, while the industry average stands at 1.6x.

Aug. 17 2018, Updated 7:31 a.m. ET

Price-to-book value ratio

The price-to-book value (or PB) ratio is considered to be the best multiple to value commercial banking stocks, as the bank’s assets and liabilities are generally valued at market prices. The PB ratio compares a company’s current market price to its book value.

Usually, banking stocks (XLF) trade in the range of 1x–2x to their book values. Stocks trading lower than their book values are considered to be generating poor returns. If their other fundamental growth drivers are in good shape, these stocks are believed to be undervalued and could attract investors’ attention.

Where the top five US banks stand

The largest US bank (on the basis of total amount of assets held), JPMorgan Chase (JPM), currently trades at a significantly higher PB ratio in comparison with the banking services industry average. On a trailing-12-months (or TTM) basis, JPMorgan Chase trades at a PB ratio of 1.7x, while the industry average stands at 1.6x.

The other top US banks—Bank of America (BAC), Wells Fargo (WFC), Citigroup (C), and Goldman Sachs (GS)—are trading at a discount to the industry average, with respective multiples of 1.31x, 1.56x, 1.0x, and 1.2x.

On the basis of Wall Street’s 2018 expectations, JPMorgan Chase, Bank of America, Wells Fargo, Citigroup, and Goldman Sachs trade at PB multiples of 1.64x, 1.26x, 1.54x, 0.95x, and 1.19x, respectively. This JPMorgan Chase trades at a premium to its peers on the basis of its forward estimates.

For fiscal 2018, Wall Street expects JPMorgan Chase, Bank of America, Wells Fargo, Citigroup, and Goldman Sachs, to report earnings per share of $9.17, $2.55, $4.33, $6.57, and $24.90, respectively.