What’s Gilead Sciences’ Valuation?

Gilead’s stock price has risen ~8.9% in the last 12 months. Wall Street analysts estimate that the stock price will fall ~4.5% over the next 12 months.

Nov. 20 2020, Updated 1:17 p.m. ET

Gilead Sciences’ valuation

Headquartered in Foster City, California, Gilead Sciences (GILD) is one of the leading biopharmaceutical companies involved in discovering, developing, and commercializing innovative medicines.

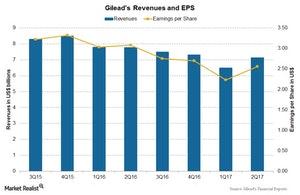

The above chart shows revenues and earnings per share (or EPS) for Gilead over the last few quarters. Gilead reported EPS of $2.56 on revenues of $7.1 billion during 2Q17, nearly an 8% decline as compared to $3.08 on revenues of $7.8 billion during 2Q16.

Forward PE

PE multiples represent what one share can buy for an equity investor. As of September 8, 2017, Gilead was trading at a forward PE multiple of 10.7x as compared to an industry average of 12.9x. Other competitors like Amgen (AMGN), Biogen (BIIB), and Celgene (CELG) trade at a forward PE of 13.9x, 13.8x, and 16.4x, respectively.

Forward EV-to-EBITDA

On a capital-structure-neutral and excess-cash-adjusted basis, Gilead currently trades at ~7.7x, which is lower than the industry average of 10.6x. Other competitors like Amgen, Biogen, and Celgene trade at a forward EV-to-EBITDA multiple of 9.1x, 10.0x, and 12.4x, respectively.

Analyst recommendations

According to data from September 7, 2017, Gilead’s stock price has risen ~8.9% in the last 12 months. Wall Street analysts estimate that the stock price will fall ~4.5% over the next 12 months. Analysts’ recommendations show a 12-month targeted price of $81.33 per share compared to the last price of $82.95 per share as of September 6, 2017. A total of 25 analysts track Gilead Sciences stock. Of these, 13 analysts recommend a “buy” and 12 analysts recommend a “hold.” The consensus rating on Gilead’s stock is 2.3, a moderate buy for value investors.

To divest the company-specific risks, investors can consider ETFs like the Virtus LifeSci Biotech Products ETF (BBP), which holds ~3.3% of its total assets in Gilead Sciences, or the iShares Global Healthcare ETF (IXJ), which holds 2.4% of its total assets in Gilead Sciences. BBP also holds 3.2% in Biogen (BIIB), 2.9% in Celgene (CELG), and 2.7% in Amgen (AMGN).