Understanding EOG Resources’ Q2 2018 Production Guidance

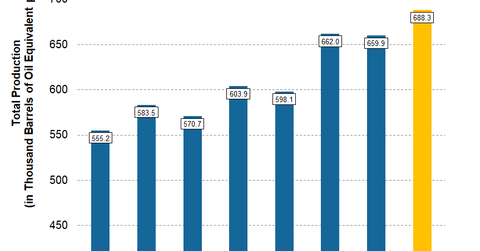

For the second quarter, EOG Resources expects total production in the range of 670.3–706.2 Mboepd (thousand barrels of oil equivalent per day).

Dec. 4 2020, Updated 10:53 a.m. ET

Second-quarter production guidance

For the second quarter, EOG Resources (EOG) expects total production in the range of 670.3–706.2 Mboepd (thousand barrels of oil equivalent per day). On a YoY (year-over-year) basis, the midpoint of EOG Resources’ second-quarter production guidance range is ~14% compared to its production of 603.9 Mboepd in the second quarter of 2017.

Even sequentially, EOG Resources’ second-quarter production guidance is ~4% higher than its first-quarter production of 659.9 Mboepd.

EOG’s YoY increase in production can also be attributed to its higher capex, which resulted in higher exploration and production activity levels. We’ll study EOG’s capex and cash flows in the next article.

EOG Resources’ 2018 production guidance

For 2018, EOG Resources expects full-year production in the range of 685.8–728.5 Mboepd, ~16% higher than its production in 2017. EOG expects its assets in the Delaware Basin and the Eagle Ford Basin to drive its production growth in 2018.

EOG’s peers, which are also focusing on US resource plays, especially the Permian Basin, for their 2018 production growth are ConocoPhillips (COP), Occidental Petroleum (OXY), Encana (ECA), and Devon Energy (DVN). COP, OXY, ECA, and DVN are expecting overall production growths of ~5%, ~8%, ~18%, and ~1%, respectively, in 2018.