Keytruda: Driving Merck’s Growth

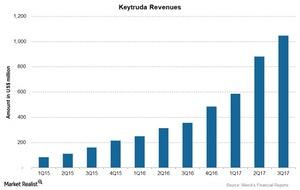

For 3Q17, Keytruda reported revenues of ~$1.1 billion, a 194% growth compared to revenues of $356 million in 3Q16.

Dec. 1 2017, Updated 7:33 a.m. ET

Keytruda

Keytruda is one of the blockbuster drugs for Merck & Co.’s (MRK) immuno-oncology portfolio. Keytruda was launched in 2014 and is currently approved for seven indications.

The above chart shows revenues of Keytruda over the last 11 quarters. For 3Q17, Keytruda reported revenues of ~$1.1 billion, a 194% growth compared to revenues of $356 million in 3Q16. Growth includes a 192% increase in operating revenues and a 2% positive impact of foreign exchange.

Keytruda’s uses

As stated above, Keytruda is approved for the treatment of the following seven forms of tumors:

- squamous cell carcinoma of the head and neck

- classical Hodgkin’s lymphoma

- microsatellite instability-high cancer

- advanced non-small cell lung cancer

- advanced melanoma

- advanced urothelial bladder cancer

- advanced gastric cancer

Recent developments for Keytruda

Keytruda is one of the most important drugs developed by Merck & Co. With more than 500 clinical studies, the drug is being evaluated as a monotherapy as well as a combination drug for the treatment of more than 30 tumor types.

On September 22, 2017, the FDA (U.S. Food & Drug Administration) approved Keytruda for use in the treatment of PD-L1 positive advanced or metastatic gastric or gastroesophageal junction cancer in patients reporting disease progression after two or more previous therapies, including fluoropyrimidine and platinum-containing chemotherapy, and in certain cases where HER2/neu-targeted therapy was given to patients.

The recent developments of Keytruda are discussed in the next part of this series.

The PowerShares Dynamic Pharmaceuticals ETF (PJP) holds 4.2% of its total assets in Merck & Co. (MRK), 5.2% in Pfizer (PFE), 5.1% in Johnson & Johnson (JNJ), and 3.3% in Mylan (MYL).