Is This Why CF’s Stock Has Rallied?

Like CF Industries’ (CF) sales, its margins are also expected to expand YoY (year-over-year) in Q2 2018 and the next four quarters.

Dec. 4 2020, Updated 10:53 a.m. ET

Margins

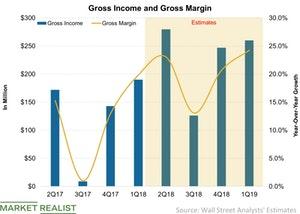

Like CF Industries’ (CF) sales, its margins are also expected to expand YoY (year-over-year) in Q2 2018 and the next four quarters. In the second quarter, analysts expect CF Industries’ margins to expand 62% YoY to $279 million from $172 million. Analysts’ expectation of just an 8% sales increase suggests they expect a significant benefit from lower costs of goods per unit. Similarly, CF’s gross margins are expected to grow 78% YoY to $913 million in the next four quarters, to 20.6% from $12.7%.

Lower costs

Over the past two years, CF Industries and other fertilizer companies (XLB) such as Nutrien (NTR), Mosaic (MOS), and Intrepid Potash (IPI) have taken initiatives to lower production costs to sustain their margins amid low fertilizer prices. CF Industries’ efforts seem to have paid off.

Meanwhile, natural gas prices have been stable at under $3 per million British thermal units this year, boosting nitrogen companies. Next, we’ll discuss analysts’ expectations for CF’s core profitability—its EBITDA.