How Has Noble Energy Stock Been Performing Recently?

Year-over-year, NBL stock has risen ~22.7%, while crude oil prices have surged 46.5% in the same period.

July 26 2018, Updated 10:31 a.m. ET

Noble Energy’s stock performance this year

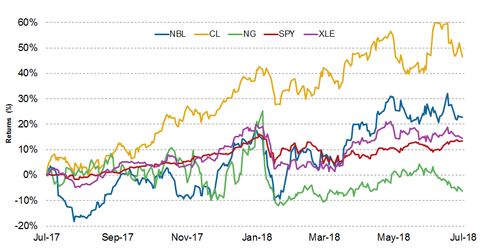

Noble Energy (NBL) stock has risen since the beginning of this year, mirroring crude oil prices (DBO). Year-over-year, NBL stock has risen ~22.7%, while crude oil prices have surged 46.5% in the same period. Natural gas prices (UNG) have declined 6.14% in the same period.

As shown in the chart below, NBL stock has overperformed the Energy Select Sector SPDR ETF (XLE), which has risen 14.51% year-over-year. NBL stock has overperformed the S&P 500 SPDR ETF (SPY), which has risen ~13.52% year-over-year.

NBL’s outlook through 2020

NBL management also provided its production outlook through 2020. The company expects its production volumes to grow to approximately 525 MBoe/d in 2020, from 303 Mboe/d in 2017. NBL’s US Onshore and Leviathan operations are expected to drive this growth.

The company is expecting a 25.0% increase in its US onshore volumes between 2017 and 2020, primarily driven by the DJ and Delaware basins. Providing an update on its Leviathan project, the company said the project is approximately 45.0% complete. The project is on budget and on schedule, with its first gas sales expected by the end of 2019.

Anadarko Petroleum (APC) also provided a three-year production outlook with the DJ and Delaware basins at the forefront. The company expects these two assets combined with the Gulf of Mexico to deliver a 10.0%–14.0% compound growth rate for oil in the next three years.