Analyzing US Crude Oil Production

In the week ending March 1, the US crude oil production was 12.1 MMbpd (million barrels per day)—a record level.

Nov. 20 2020, Updated 4:56 p.m. ET

Oil rig count

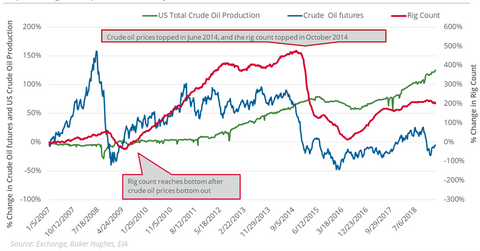

Last week, the oil rig count fell by nine to 834—the lowest level since May. The rig count tends to follow US crude oil prices with a three to six-month lag.

In February 2016, US crude oil prices fell to the lowest closing level in 12 years. Between February 11, 2016, and March 11, 2019, US crude oil active futures rose 116.7%. The oil rig count reached a 6.5-year low of 316 in May 2016. Between May 27, 2016, and March 8, 2019, the oil rig count rose ~164%. Between May 27, 2016, and March 1, 2018, US crude oil production rose ~38.5%.

US crude oil production growth

Based on the EIA’s Monthly Crude Oil Production Report released on February 28, the crude oil production in the United States fell 0.5% in December on a month-over-month basis—the first time since May.

On October 3, US crude oil active futures settled at $76.41 per barrel—the highest closing level since November 21, 2014. Based on the pattern we saw above, the oil rig count could keep rising until at least March. By the second quarter, the US crude oil production growth rate might reverse more. In the week ending November 16, the oil rig count was at 888—the highest level since March 2015.

US crude oil output and oilfield services stocks

In the week ending March 1, the US crude oil production was 12.1 MMbpd (million barrels per day)—a record level. With the fall in the oil rig count, the growth rate in US oil production might decelerate.

Since the US oil rig count hit a multiyear high on November 16, the VanEck Vectors Oil Services ETF (OIH) has fallen 14.4%. Schlumberger (SLB), Halliburton (HAL), Transocean (RIG), and Baker Hughes, a GE company (BHGE), have returned -12.7%, -14.1%, -11.3%, and 13.4%, respectively. OIH has 44% exposure to these stocks. Any slowdown in US oil drilling activities could be a concern for these stocks.

Any slowdown in US oil production might also impact broader market indexes like the S&P 500 Index (SPY) and the Dow Jones Industrial Average Index (DIA).