What Drove the Euro Higher Last Week?

The total net speculative bullish positions on the euro (EUFX) increased from 93,106 contracts to 113,889 contracts in the previous week.

Dec. 20 2017, Updated 10:32 a.m. ET

Strong ECB outlook and economic performance helps euro

The euro (FXE) closed the week ended December 15 at 1.1754 against the US dollar (UUP), remaining mostly unchanged. The key event in the previous week was the European Central Bank (or ECB) meeting, in which the ECB left rates unchanged but upgraded the economic outlook.

The ECB expects the economy to grow 2.4% in 2017 and raised its 2018 GDP forecast from 2.2% to 2.4%. Inflation forecasts, however, were left unchanged. Economic data was upbeat with services and manufacturing activities reported to have expanded in the previous month.

European equity markets (VGK) remained weak despite the positive economic data, as the German political drama continued. The German DAX (DAX) ended the week 0.38% lower, the Euro Stoxx (FEZ) fell 0.86%, and France’s CAC fell 0.92% in the previous week.

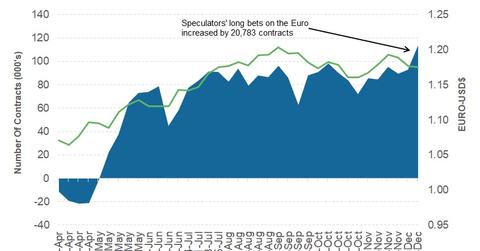

Euro speculators increase bullish bets

According to the latest Commitment of Traders report, which was released on December 15 by the Chicago Futures Trading Commission, speculators increased long euro positions by 20,783 contracts last week.

The total net speculative bullish positions on the euro (EUFX) increased from 93,106 contracts to 113,889 contracts in the previous week. A further decline in the US dollar, which could occur if the tax reform bill is not passed, could drive the euro much higher this week.

Outlook for the euro

Europe’s shared currency could be supported on the back of positive economic performance and the optimistic outlook from the ECB. Key economic data scheduled to be reported this week include the German IFO expectations, wage growth, and revised inflation numbers for November.

Overall, we can expect the euro to remain supported. If the US tax bill fails to take shape, the euro can bounce back above the 1.18 level against the US dollar.

In the next part of this series, we’ll discuss how new Brexit developments impacted the British pound last week.