Analyst Ratings for Valero: Why the ‘Hold’ Ratings?

VLO’s mean price target of $72 per share implies around a 10% gain from its current level.

April 11 2017, Updated 4:35 p.m. ET

Analyst ratings for Valero

In the previous part, we looked at Valero’s stock performance. Now, we’ll look at analyst ratings for Valero (VLO).

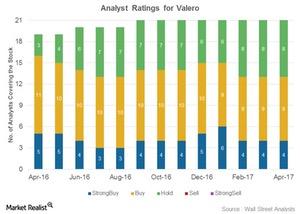

The analyst rating chart below shows that 13 out of the 21 analysts covering VLO have rated it a “buy.” Another eight analysts have rated Valero as a “hold.” VLO’s mean price target of $72 per share implies around a 10% gain from its current level.

Compared to April 2016, the ratings have weakened as the “buy” ratings have fallen and “hold” ratings have increased. Also, after its earnings release, VLO saw cuts in its target prices from investment banking firms.

JPMorgan, who has an “overweight” rating on the stock, cut its target price to $72 from $73. Also, Morgan Stanley cut its target price to $77 from $80. Barclays has cut VLO’s target price to $85 from $95. Barclays has an “outperform” rating on the stock.

But why the “hold” ratings?

In addition to its “buy” ratings, Valero also has “hold” ratings. Valero has a sound leverage position, a robust cash flow standing, and has delivered shareholder returns in the form of dividends and buybacks. No wonder most analysts rate Valero a “buy.”

However, a few analysts also rate Valero as a “hold,” which is likely due to its high and uncertain RINs (renewable identification number) purchase burden, which sharply impacts Valero’s earnings. For more on RINs, you can refer to If Only the RFS Program Rumors Were True.

Peer ratings

By comparison, for Marathon Petroleum (MPC), 89% of Wall Street analysts covering the stock have given “buy” ratings. For Phillips 66 (PSX) and Tesoro (TSO), 21% and 67% of analysts have given a positive recommendation, respectively. Other smaller players like Western Refining (WNR), Delek US Holdings (DK), and Alon USA Energy (ALJ) are rated as a “buy” by 25%, 35%, and 25% of analysts, respectively.

For exposure to small-cap value stocks, you can consider the iShares Russell 2000 Value ETF (IWN). The ETF has ~5% exposure to energy sector stocks including DK, WNR, and ALJ.

Move on to next part to look at Valero’s dividend yield.