MPC’s Dropdown Plans: Where Do Its Valuations Stand?

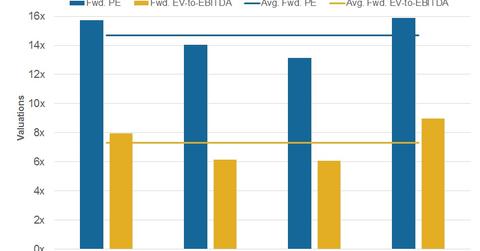

After MPC proposed the dropdown plan, MPC’s forward price-to-earnings (or PE) and EV-to-EBITDA stood at 15.7x and 8x, respectively.

Jan. 4 2017, Updated 10:05 a.m. ET

MPC’s dropdown plans: A look at valuations

In this part, we’ll look at Marathon Petroleum’s (MPC) valuations. After MPC proposed the dropdown plan, which we discussed in the previous part, MPC’s forward price-to-earnings (or PE) and EV-to-EBITDA stood at 15.7x and 8x compared to its peer averages, which stood at 14.7x and 7.3x, respectively.

MPC trades above peers Tesoro (TSO) and Valero Energy (VLO) on both the valuation multiples, which is likely because of the 5% rise in Marathon Petroleum’s stock price after unveiling the strategic plan. But MPC trades below Phillips 66 (PSX) on both the valuation metrics, likely because PSX has a more diversified downstream business model. For exposure to refining stocks, investors can consider the iShares North American Natural Resources ETF (IGE). The ETF has ~7% exposure to refining and marketing sector stocks.