RAAX ETF: Capturing Real Benefits of Real Assets

RAAX’s allocation process provides exposure to segments with better returns profiles while managing overall portfolio risk.

July 25 2018, Updated 7:33 a.m. ET

VanEck

The actively managed VanEck Vectors® Real Asset Allocation ETF (RAAX) offers investors the ability to access the potential benefits of real assets. By offering potential exposure across commodities, natural resource equities, REITs, MLPs, and infrastructure, with the ability to allocate up to 100% to cash and cash equivalents during market stress, RAAX helps address the impact of volatility long associated with real asset investing through a process that responds to changing market environments.

Market Realist

The VanEck Vectors Real Asset Allocation ETF

The VanEck Vectors Real Asset Allocation ETF (RAAX) aims to generate a long-term total return. While trying to achieve its investment objective, the fund seeks to limit market drawdowns during adverse conditions by allocating primarily to exchange-traded products that provide exposure to real assets such as commodities (DBC) (PDBC), real estate (VNQ), natural resources, and infrastructure (IGF).

Rules-based approach

RAAX seeks to ease downside risk by using a rules-based approach to determine when to allocate a portion or all of the fund’s assets to cash and cash equivalents. In view of the changing market dynamics, the fund reserves the right to allocate 100% to cash during market stress.

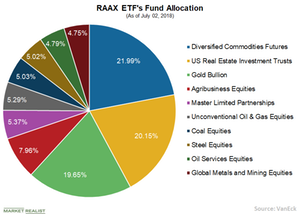

The fund’s allocation process provides exposure to segments with better returns profiles while managing overall portfolio risk. As of July 2, the fund’s largest allocation was in diversified commodities futures at 21.99%, followed by US REITs (20.15%), gold bullion (19.65%), agribusiness equities (7.96%), and MLPs (5.37%).