Why Most Analysts Recommend ‘Holds’ on BP

Analysts’ ratings for BP (BP) show that 31% of those covering the stock rate it as a “buy,” and 61% rate it as a “hold.”

Aug. 18 2016, Updated 9:05 a.m. ET

Most analysts recommend “holds” on BP

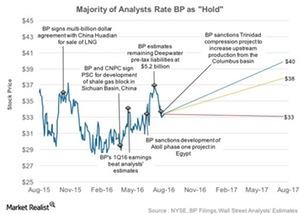

Analysts’ ratings for BP (BP) show that 31% of those covering the stock rate it as a “buy,” and 61% rate it as a “hold.” The highest 12-month price target for BP stands at $40, indicating a 20% rise from its current level.

However, 8% of analysts rate BP as a “sell.” The stock’s lowest price target of $33 implies a 1% fall. The stock’s average 12-month price target stands at $38, indicating a 14% rise from its current level.

BP’s peers Petrobras (PBR), PetroChina (PTR), and Cenovus Energy (CVE) have been rated as “buys” by 25%, 25%, and 48% of analysts, respectively.

If you’re looking for exposure to integrated energy sector stocks, you may want to consider the iShares North American Natural Resources ETF (IGE). The ETF has ~21% exposure to the sector.

BP’s overall strategy

BP has been facing the double whammy of lower oil prices and its Gulf of Mexico oil spill charges. The Gulf of Mexico oil spill pretax charges for 2Q16 stood at $5.2 billion, including additional provisions created to satisfy the remaining estimated outstanding claims. BP believes that any other claims not covered under this provision are not likely to radically impact its financial performance going forward.

To overcome this double whammy, BP plans to reduce its costs. By 2017, the company aims to reduce its annual cash costs by $7 billion compared to 2014. BP is also continuing to restructure its portfolio by divesting its nonstrategic assets. BP’s divestment proceeds for 2Q16 stood at $0.4 billion, compared to $0.5 billion in 2Q15.

BP is also continuing to optimize its capital expenditure (or capex). BP’s organic capex stood at $3.9 billion in 2Q16, compared to $4.5 billion in 2Q15. BP expects its capex to be around $17 billion in 2016, with an option to reduce it to the range of $15 billion–$17 billion if the situation warrants.

BP’s strategy of lowering its costs, divesting its nonstrategic assets, and optimizing its capex should work in its favor. However, until concrete results are visible in terms of improving fundamentals, most analysts have likely adopted a cautious approach, rating the stock as a “hold.”