Where Does Apple Stand in the Global Smartphone Market?

Apple (AAPL) had a market share of 14.9% in the global Smartphone market at the end of 1Q17. Apple’s market share in 1Q16 was 15.4%.

July 20 2017, Updated 5:35 p.m. ET

Apple had a share of 14.9% at the end of 1Q17

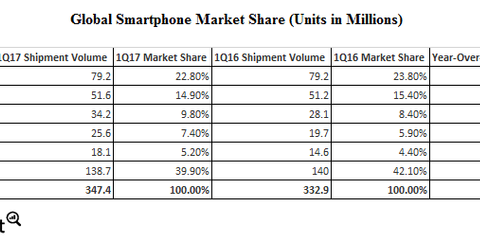

Apple (AAPL) had a market share of 14.9% in the global Smartphone market at the end of 1Q17. Apple’s market share in 1Q16 was 15.4%. Korean (EWY) heavyweight Samsung (SSNLF) was the largest Smartphone manufacturer in 1Q17, with shipments of 79.2 million units and a market share of 22.8%.

The other top players included Chinese manufacturers Huawei, OPPO Electronics, and Vivo with market shares of 9.8%, 7.4%, and 5.2%, respectively, at the end of 1Q17.

While Samsung’s and Apple’s unit shipments were flat or marginally improved YoY (year-over-year) in 1Q17, Huawei’s shipments rose almost 22%. OPPO’s and Vivo’s shipments rose 29.8% and 23.6%, respectively, in 1Q17.

Huawei’s Mate 9 has sold over 5 million units since it was launched in November 2016. OPPO and Vivo have been focusing on emerging markets such as India (INDA) and China to drive sales.

Apple briefly held the top position in the global Smartphone market

At the end of 4Q16, Apple displaced Samsung as the leading Smartphone manufacturer after eight quarters. Apple led the market with a share of 17.9%, narrowly surpassing Samsung’s share of 17.8% at the end of 4Q16.

Samsung’s market share fell in 4Q16 due to the recall of its defective Galaxy Note 7.