Analysts’ Ratings for ExxonMobil after Its Earnings

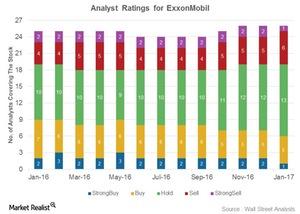

Six analysts gave ExxonMobil a “buy” rating, 13 analysts gave it a “hold” rating, and seven analysts gave it a “sell” rating after its 4Q16 earnings.

Feb. 1 2017, Updated 2:35 p.m. ET

Analysts’ ratings

In this series, we examined ExxonMobil’s (XOM) 4Q16 earnings versus estimates. We analyzed ExxonMobil’s segmental earnings in 4Q16. We also discussed ExxonMobil’s stock performance after its earnings release on January 31, 2017. In this part, we’ll examine analysts’ ratings for ExxonMobil after its earnings.

After its earnings, ExxonMobil was rated by 26 analysts. Six analysts (or 23%) assigned “buy” or “strong buy” ratings, 13 analysts (or 50%) assigned “hold” ratings, and seven analysts (or 27%) assigned “sell” or “strong sell” ratings on the stock.

ExxonMobil could witness a change in the ratings as analysts drill further down the 4Q16 numbers. ExxonMobil’s mean target price of $89 per share implies a 6% gain from the current level.

Analysts’ ratings for peers

ExxonMobil’s peers Chevron (CVX), Royal Dutch Shell (RDS.A), and BP (BP) have been rated as a “buy” by 69%, 92%, and 42% of the analysts, respectively. Other global players like Statoil (STO), Petrobras (PBR), and YPF (YPF) have been rated as a “buy” by 60%, 22%, and 77% of the analysts, respectively.

If you’re looking for exposure to integrated energy sector stocks, you can consider the iShares North American Natural Resources ETF (IGE). IGE has 21% exposure to the sector.

In the next part, we’ll look at the change in implied volatility in ExxonMobil after its 4Q16 earnings.