Valero Ranks 2nd in Dividend Yield and Market Capitalization

Valero Energy (VLO) is the second-highest dividend-yielding stock among the seven refining stocks we’re looking at in this series.

Dec. 4 2020, Updated 10:53 a.m. ET

Valero’s dividend yield

Valero Energy (VLO) is the second-highest dividend-yielding stock among the seven refining stocks we’re looking at in this series. Valero is an American downstream company with refining, midstream, and ethanol business segments. Its market cap (capitalization) of $40 billion ranks it second among our seven companies.

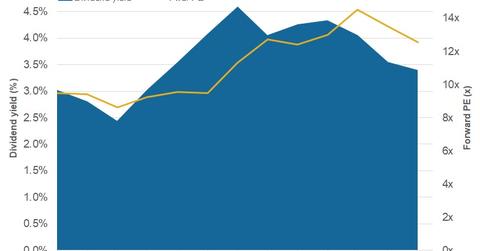

Valero has a current dividend yield of 3.4%. In 1Q18, it made a dividend payment of $0.80 per share. The dividend was declared on January 23, 2018, and paid on March 6, 2018. VLO has paid dividends consistently in the past three years, and they have doubled in that period. Three years ago, VLO made a dividend payment of $0.40 per share on March 3, 2015. Its peer HollyFrontier’s (HFC) dividend payments have also risen in the past three years.

Valuations

Valero trades at a current forward PE (price-to-earnings) ratio of 12.5x. It has risen from 9.5x in 1Q15.

Valero currently trades below the peer average forward PE ratio of 12.8x. VLO is progressing on its growth path with an aim to create an integrated downstream value chain. It has a sturdy debt position and surplus cash flow. However, its earnings are being impacted by high compliance costs. VLO is the second of our seven companies in this series to be impacted by this expense.

VLO has incurred ~$942 million to purchase RINs (Renewable Identification Numbers) in 2017, which was 26% of its operating earnings. Similarly, in 2016, it incurred ~$750 million for RINs. The company expects the cost to be $750 million–$850 million in 2018. The cost is continually denting its earnings. Similarly, PBF Energy’s (PBF) RIN costs were $294 million in 2017. HollyFrontier’s (HFC) RIN expenses were $288 million in 2017.

Thus, VLO is trading below the peer average, presumably due to the RIN acquisition burden.

Next, let’s look at Philips 66 (PSX), which ranks third in terms of current dividend yield.