Novartis’s 1Q17 Earnings: Recent Developments

On January 6, 2017, Novartis announced the collaborative agreement with Ionis Pharmaceuticals (IONS) and its subsidiary Akcea Therapeutics.

April 28 2017, Updated 10:37 a.m. ET

Recent developments

As we’ve already seen, Novartis (NVS) reported operational growth across all segments during 1Q17. Now let’s look at some recent developments for the company.

Corporate developments

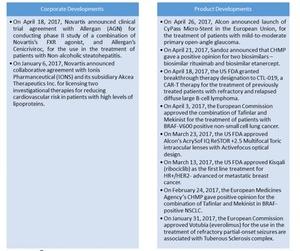

Below are some of Novartis’s recent corporate developments:

- On April 18, 2017, Novartis announced the clinical trial agreement with Allergan (AGN) to conduct a Phase II study of a combination of Novartis’s FXR agonist and Allergan’s cenicriviroc for use in the treatment of patients with non-alcoholic steatohepatitis.

- On January 6, 2017, Novartis announced the collaborative agreement with Ionis Pharmaceuticals (IONS) and its subsidiary Akcea Therapeutics to license two investigational therapies for reducing cardiovascular risk in patients with high levels of lipoproteins. The two therapies are AKCEA-APO(A)-LRx and AKCEA-APOCIII-LRx.

Product developments

Now let’s look at some of Novartis’s product developments:

- On April 26, 2017, Alcon announced the launch of CyPass Micro-Stent in the European Union for the treatment of patients with mild-to-moderate primary open-angle glaucoma. CyPass Micro-Stent is a micro-invasive glaucoma surgical device.

- On April 21, 2017, Sandoz announced that the European Medicines Agency’s Committee for Medicinal Products for Human Use (or CHMP) gave a positive opinion for two biosimilars: biosimilar rituximab and biosimilar etanercept. Biosimilar rituximab is the biosimilar version of Roche’s (RHHBY) MabThera. The biosimilar etanercept is the biosimilar version of Amgen’s (AMGN) Enbrel.

- On April 18, 2017, the FDA (U.S. Food and Drug Administration) granted breakthrough therapy designation for CTL019, a CAR-T (chimeric antigen receptor T-cell) therapy for the treatment of previously treated patients with refractory and relapsed diffuse large B-cell lymphoma.

- On April 3, 2017, the European Commission approved the combination of Tafinlar and Mekinist for the treatment of patients with BRAF V600 positive non-small cell lung cancer.

- On March 23, 2017, the FDA approved Alcon’s AcrySof IQ ReSTOR +2.5 Multifocal Toric intraocular lenses with ActiveFocus optical design. These lenses are designed for patients undergoing cataract surgery for astigmatism and presbyopia correction at the same time.

- On March 13, 2017, the FDA approved Kisqali (ribociclib), a CDK4/6 inhibitor, as the first line of treatment for HR+/HER2- advanced or metastatic breast cancer.

- On February 24, 2017, the CHMP gave a positive opinion for the combination of Tafinlar and Mekinist in BRAF-positive non-small cell lung cancer.

- On January 31, 2017, the European Commission approved Votubia (everolimus) for use in the treatment of refractory partial-onset seizures associated with tuberous sclerosis complex.

- On January 26, 2017, Alcon launched new intraocular lenses, AcrySof IQ PanOptix Toric presbyopia-correcting and astigmatism-correcting lenses for use in patients with pre-existing corneal astigmatism.

To divest the risk, investors can consider ETFs such as the Schwab International Equity ETF (SCHF), which holds 0.50% of its total assets in Novartis.