Distillate Inventories Increased Last Week

Distillate demand drives crude demand and crude prices. So, energy investors watch distillate inventories closely.

April 27 2015, Updated 10:06 a.m. ET

Distillate inventories

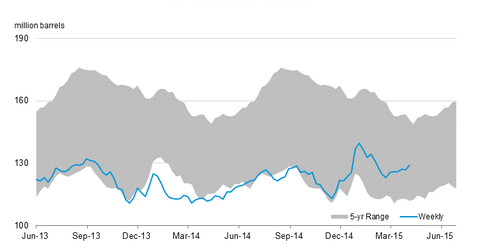

In its “Weekly Petroleum Status Report” released on April 15, the EIA (U.S. Energy Information Administration) says that distillate stocks increased by 2 MMbbls (million barrels) last week to finish at ~128.9 MMbbls in the week ending April 10. Analysts were expecting inventories to increase by 700,000 barrels. Inventories remain in the lower part of the five-year range.

When inventories increase more than expected, it’s bearish for distillate prices. That negatively affects the margins of refineries such as Tesoro (TSO) that makes up 2.2% of the Energy Select Sector SPDR ETF (XLE).

Bearish distillate prices can also be negative for the MLP subsidiaries of refineries that carry refined products. TSO’s MLP subsidiary is Tesoro Logistics (TLLP). Other refinery MLP subsidiaries include Phillips 66 Partners (PSXP) and Shell Midstream Partners (SHLX).

Factors that affected inventory movement last week

Distillate production remained flat last week, compared to the previous week. The EIA reports that distillate products supplied averaged 4 MMbpd (million barrels per day) for the last four weeks. That’s 2.9% more than in the same period last year.

Distillate demand decreased from ~4.21 MMbpd to ~3.80 MMbpd in the week ended April 10. The decrease seems to have caused inventories to increase as production remained flat. Net trade flows also impact inventories.

Distillate demand drives crude demand

Distillate demand drives crude demand and crude prices. So, energy investors watch distillate inventories closely. Distillate inventories give a handy snapshot of distillate demand and supply trends.

In the next and last part of this series, we’ll take a look at the latest week’s movement in Cushing inventories.