Analyzing the Top MLP Closed-End Funds in 1Q18

NTG invests primarily in MLPs and their affiliates. The fund has ~$1 billion of assets under management. NTG focuses on natural gas infrastructure MLPs.

Nov. 20 2020, Updated 11:59 a.m. ET

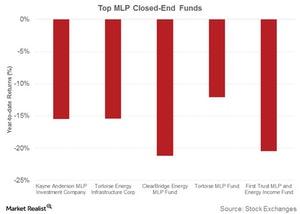

Top MLP closed-end funds

The Kayne Anderson MLP Investment Company (KYN), Tortoise Energy Infrastructure (TYG), the ClearBridge Energy MLP Fund (CEM), the Tortoise MLP Fund (NTG), and the First Trust MLP and Energy Income Fund (FEI) are the top MLP closed-end funds by assets under management. The funds returned -15.5%, -15.4%, -21.2%, -12.1%, and -20.5%, respectively, in 1Q18.

NTG

NTG invests primarily in MLPs and their affiliates. The fund has ~$1 billion of assets under management. The fund focuses on natural gas infrastructure MLPs. Currently, NTG has invested 34% in natural gas/natural gas liquids pipelines and 30% in gathering and processing assets.

Energy Transfer Partners (ETP), Enterprise Products Partners (EPD), and MPLX (MPLX) are NTG’s top three holdings. They account for 9.7%, 8.5%, and 6.7%, respectively, of the fund.

TYG also invests primarily in MLPs. The fund’s top three holdings are Energy Transfer Partners, Magellan Midstream Partners (MMP), and Enterprise Products Partners.

CEM

With ~$1.4 billion of assets under management, CEM invests primarily in energy-related MLPs. The fund’s top holdings are Enterprise Products Partners, Energy Transfer Partners, and ONEOK (OKE). They account for ~9.9%, 6.8%, and 6.4%, respectively, of CEM’s portfolio.

KYN

KYN is the largest closed-end MLP fund with assets under management of ~$3 billion. More than 85% of the fund’s portfolio is invested in MLPs. Enterprise Products Partners, Energy Transfer Partners, and Williams Partners (WPZ) are the top three holdings. They form 14.2%, 10.1%, and 8.3%, respectively, of KYN.

For the latest news on energy MLPs, visit Market Realist’s Energy MLPs page.