Why Energy Transfer Partners’ Earnings Are on the Rise

Energy Transfer Partners (ETP) reported adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) of $1.9 billion in 4Q17.

Nov. 20 2020, Updated 4:27 p.m. ET

ETP’s earnings growth

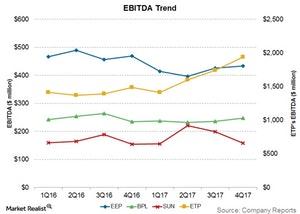

Energy Transfer Partners (ETP) reported adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) of $1.9 billion in 4Q17, a 31% rise from its EBITDA of $1.5 billion in 4Q16. The company’s EBITDA have been on an upward trend for the last three quarters. ETP’s Bakken Pipeline system (which began service in 2Q17), an acquired crude oil gathering system in West Texas, and certain joint venture crude oil transportation assets drove its Crude Oil Transportation and Services segment’s performance in 4Q17.

The segment’s earnings more than doubled in 4Q17, significantly contributing to ETP’s EBITDA growth. For more about ETP’s recent performance, read Which Segment Drove Energy Transfer Partners’ 4Q17 Performance? The above chart compares Energy Transfer Partners’, Enbridge Energy Partners’ (EEP), Buckeye Partners’ (BPL), and Sunoco’s (SUN) adjusted EBITDA over the last eight quarters.

EEP’s EBITDA

As the graph shows, Buckeye Partners’ EBITDA have been relatively stable over the last few quarters. In comparison, Enbridge Energy Partners’ 4Q17 adjusted EBITDA fell 8.3% year-over-year, driven by the sale of certain assets and a decline in volumes in EEP’s North Dakota system.

Policy changes and EEP’s earnings

With the FERC’s (Federal Energy Regulatory Commission) latest policy revision to disallow income tax allowance cost recovery in interstate MLP pipeline rates, Enbridge Energy Partners adjusted its 2018 DCF (distributable cash flow) guidance again. On March 16, 2018, EEP revised its DCF guidance to $650 million–$700 million and distribution coverage to ~1.0x from ~1.15x.

In its 4Q17 earnings release in February, Enbridge Energy Partners had revised its 2018 DCF guidance to $720 million–$770 million from $775 million–$825 million. The company attributed the guidance adjustment to the possibility of the income tax allowance of tolls in certain projects regulated by the FERC being lowered due to changes in the corporate tax rate. In the next part, we’ll discuss the abovementioned companies’ dividend trends over the years.