Altria Stock Rose on Strong 4Q16 Earnings

Altria Group (MO) announced its 4Q16 earnings on February 1, 2017. The company posted net revenue of $4.7 billion and EPS (earnings per share) of $5.27.

Feb. 2 2017, Updated 3:49 p.m. ET

Stock performance

Altria Group (MO) announced its 4Q16 earnings on February 1, 2017. The company posted net revenue, excluding excise taxes, of $4.7 billion and EPS (earnings per share) of $5.27. The 4Q16 earnings got a boost from the cash the company received from the acquisition of SABMiller by Anheuser-Busch InBev (BUD). Altria held a 27% stake in SABMiller.

Altria’s adjusted EPS, excluding the impact of special items, stood at $0.68. Compared to 4Q15, the company’s revenue rose 0.1%, while its adjusted EPS rose 1.5%.

Analysts were expecting the company to post adjusted EPS of $0.67 on net revenue of $4.8 billion. Altria’s 4Q16 EPS was driven by strong performance from smokeless products and share repurchases in the last 12 months. The better-than-expected 4Q16 earnings appear to have increased investor confidence, pushing Altria’s stock price up. Altria closed February 1, 2017, at $71.39, up 0.3% from the previous day’s closing price.

Year-to-date performance

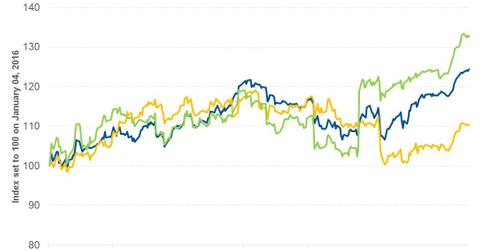

2016 was a good year for Altria with returns of 17.8%. Since the beginning of 2017, the company’s stock is up 5.6%. Altria, in partnership with Philip Morris International (PM), has submitted a modified risk tobacco product application for its IQOS, an electronically heated tobacco product. On approval, Altria will receive exclusive rights to market the product in the United States. The FDA’s approval of the IQOS as a modified risk tobacco product could be significantly advantageous and has led to a rise in Altria stock.

Year-to-date, Altria’s peers, Philip Morris International (PM) and Reynolds American (RAI) have returned 4.9% and 7%, respectively. Comparatively, the broader comparative index, the First Trust Morningstar Dividend Leaders Index ETF (FDL), returned 0.4% during the same period.

Series overview

In this series, we’ll take a look at Altria’s 4Q16 performance. We’ll compare it with the company’s performance in the same quarter last year. We’ll also explore the factors that could drive the company’s revenue, margins, and EPS in the coming quarters. Finally, we’ll look at the company’s valuation multiple and analysts’ estimates and recommendations going forward.

Let’s start by looking at Altria’s 4Q16 revenue.