First Trust Morningstar Dividend Leaders Index Fund

Latest First Trust Morningstar Dividend Leaders Index Fund News and Updates

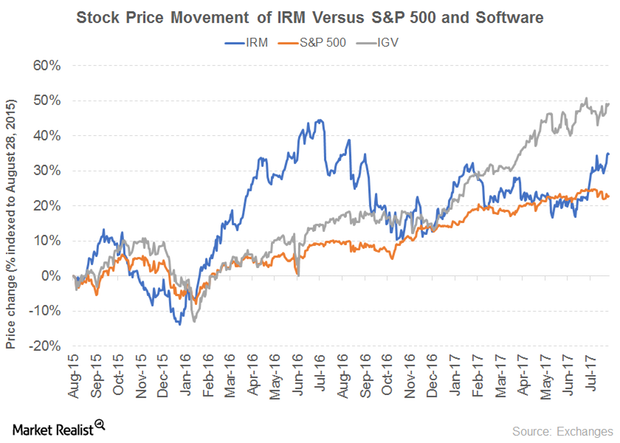

How Iron Mountain Has Maintained Its Dividend Yield

How Iron Mountain has maintained a 5% yield Iron Mountain (IRM) is an enterprise information management services company. The company’s revenue grew in 2016, supported by its North American Records and Information Management Business, North American Data Management Business, Western European Business, and Other International Business segments. Its revenue fell 4% in 2015 before rising 17% in 2016. Its operating income fell 5% in 2015 and 4% in 2016 due to […]

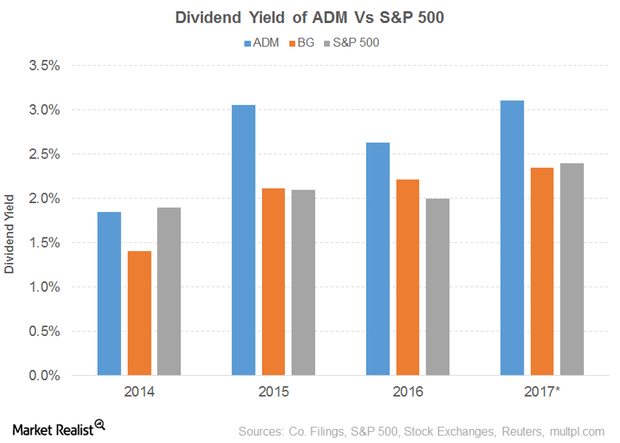

Dividend Yield of Archer-Daniels Midland

Archer-Daniels Midland’s (ADM) PE ratio of 19.1x compares to a sector average of 23.8x. The dividend yield of 3.1% compares to a sector average of 2.4%.

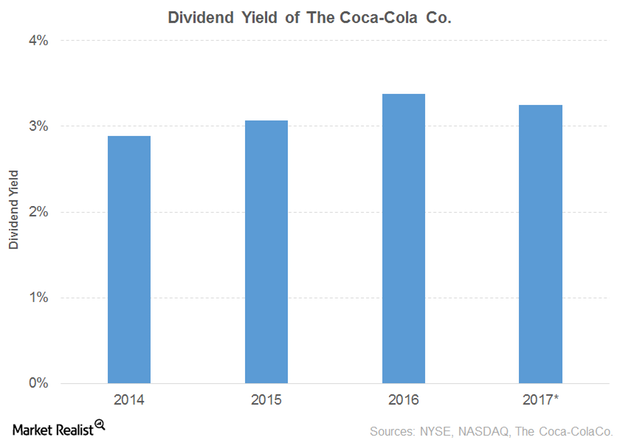

A Look at Coca-Cola’s Dividend Yield

Coca-Cola (KO) recorded a fall of 6.0% in its 2016 net operating revenues due to a decline in its Third Party and Intersegment segments.

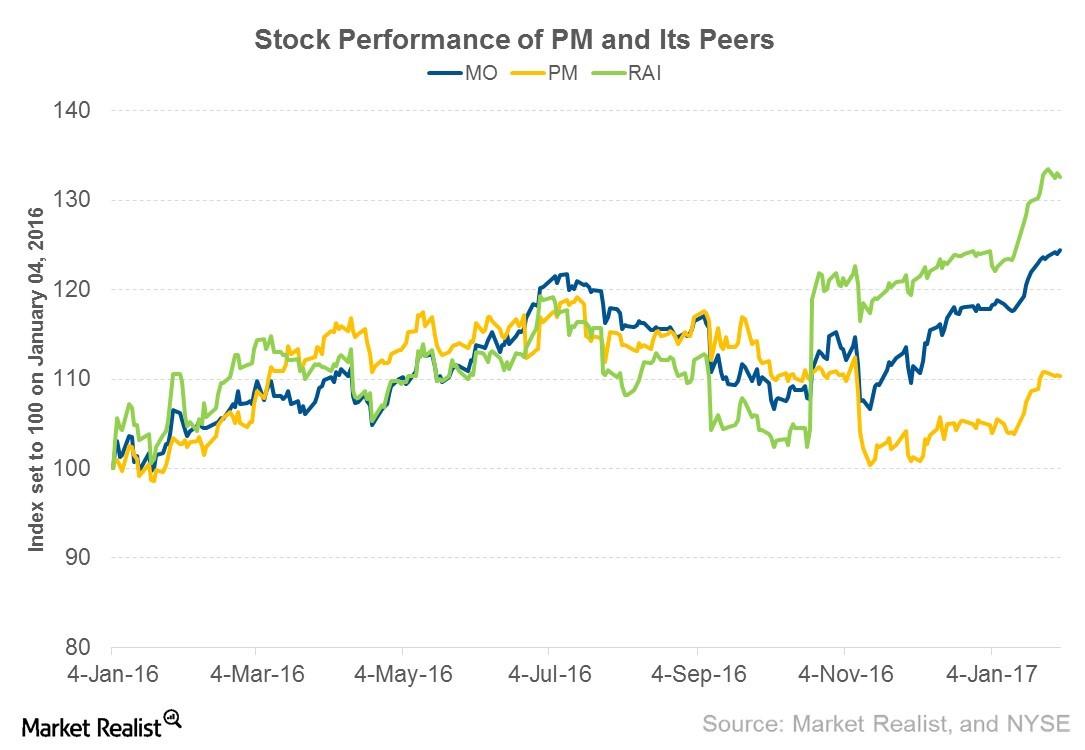

Altria Stock Rose on Strong 4Q16 Earnings

Altria Group (MO) announced its 4Q16 earnings on February 1, 2017. The company posted net revenue of $4.7 billion and EPS (earnings per share) of $5.27.

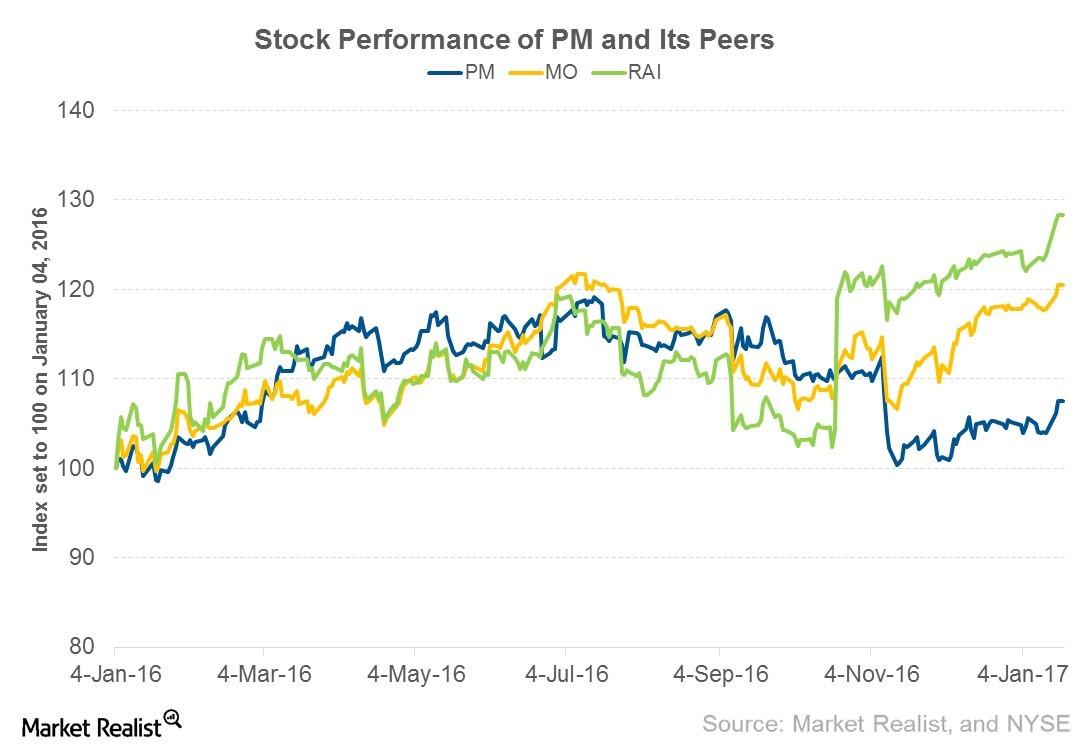

Will Philip Morris’s 4Q16 Earnings Results Boost Its Stock Price?

Philip Morris International (PM), a US-based tobacco company, is set to announce its 4Q16 earnings on February 2, 2017, before the market opens.

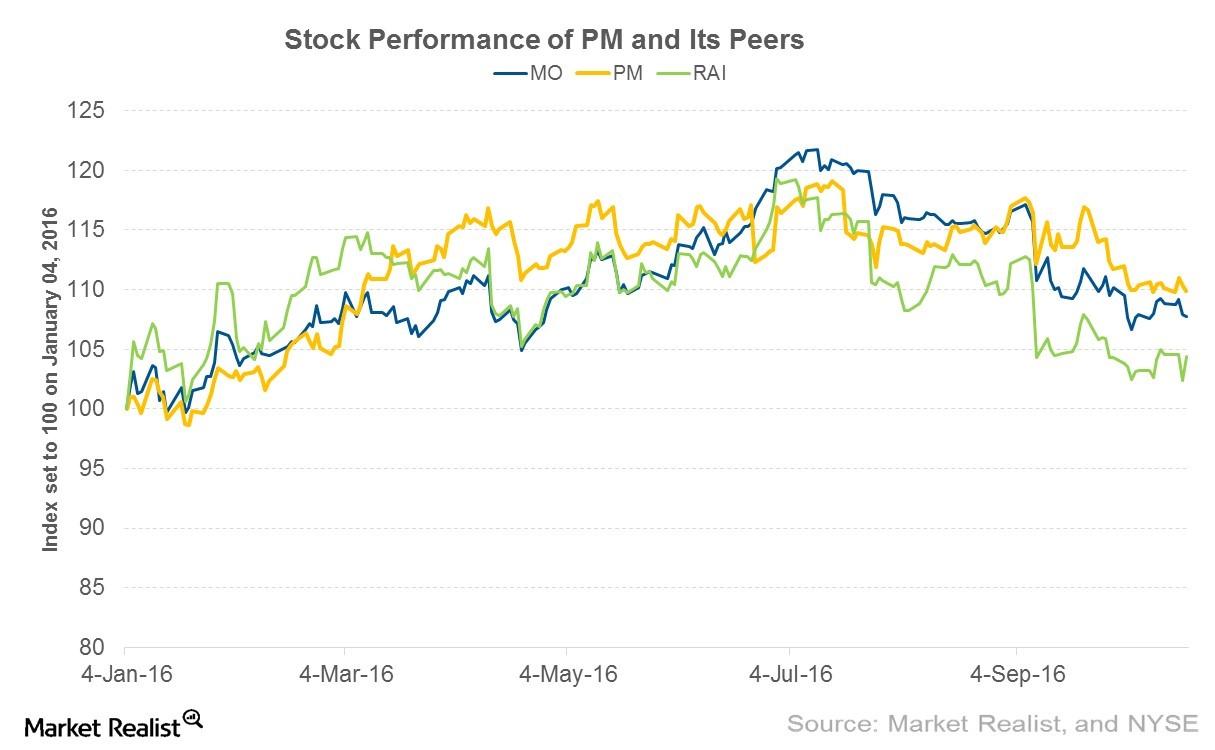

Can Investors Expect Momentum from Altria’s 3Q16 Earnings?

In 2016, Altria’s share price has risen 7.8% YTD. During the same period, peers Philip Morris and Reynolds American have risen 9.9% and 4.4%, respectively.

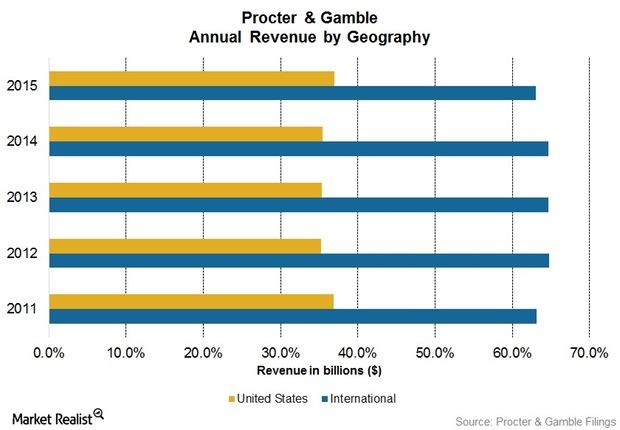

Will Negative Foreign Exchange Affect Procter & Gamble in 3Q16?

Since December 2015, FX (foreign exchange) headwinds have increased $0.3 billion after tax. That includes devaluations in Argentina, Russia, and Mexico.