How Did Boeing Stock React?

Immediately after Donald Trump’s tweet, Boeing (BA) stock fell 1%. Other defense contractor stocks also had to bear the brunt.

Dec. 8 2016, Updated 4:35 p.m. ET

Stock fell initially

Immediately after Donald Trump’s tweet, Boeing (BA) stock fell 1%. Other defense contractor stocks also had to bear the brunt. Boeing stock recovered after investors realized that the order in question would have a small impact on Boeing. In fact, the stock ended up slightly higher and closed at $152.24—compared to $152.16 the previous trading day.

On December 7, Boeing stock rose nearly 0.8% to $153.5. Peers Lockheed Martin (LMT) rose 0.19% to $266.3 and United Technologies (UTX) rose 1.8% to $109. On the other hand, peers Raytheon (RTN), General Dynamics (GD), and Northrop Grumman (NOC) fell on the same day. Raytheon fell 0.5% to $148.3, General Dynamics fell 0.2% to $177.7, and Northrop Grumman fell 0.7% to $246.

YTD 2016 performance

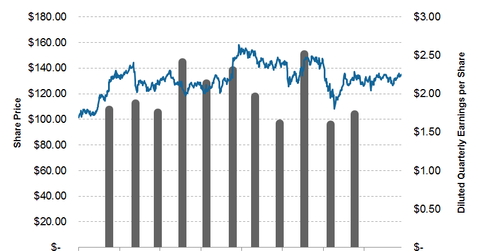

After having a rough start to the year, Boeing stock managed to recover following its 2Q16 earnings. The stock rose ~6% YTD (year-to-date)—a good reversal considering that it fell almost 10% in the first two quarters of 2016.

Although they aren’t strictly comparable, Boeing’s defense peers Lockheed Martin, United Technologies, and General Dynamics rose 22.6%, 13.6%, and 29.4% YTD, respectively.

The broader market, tracked by the SPDR S&P 500 ETF (SPY), rose 9.5% during the same period.

Read The Boeing Company: Filing a New Flight Plan for 2015 to learn more about Boeing.