A Look at KBR’s Subsidiaries

Primary subsidiaries Previously, we discussed various acquisitions completed by KBR (KBR). Let’s now take a look at some of KBR’s subsidiaries and how they fit into the big picture for the company. Energy and construction Granherne, a KBR technology and engineering subsidiary, operates in the oil and gas industry. Granherne provides front-end engineering and design services […]

Dec. 21 2017, Published 2:31 p.m. ET

Primary subsidiaries

Previously, we discussed various acquisitions completed by KBR (KBR). Let’s now take a look at some of KBR’s subsidiaries and how they fit into the big picture for the company.

Energy and construction

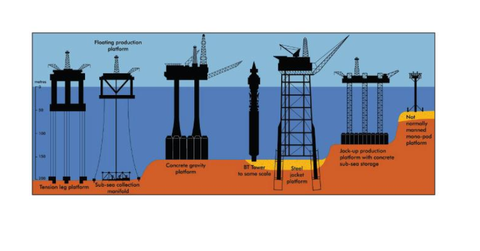

Granherne, a KBR technology and engineering subsidiary, operates in the oil and gas industry. Granherne provides front-end engineering and design services to Chevron (CVX). Energo has been a subsidiary of KBR since 2010. According to the company website, it is involved in “advanced structural engineering and integrity management.” Energo has provided services to offshore oil and gas (XLE) companies such as ExxonMobil (XOM) and Imperial Oil (IMO).

Technology sector

GVA is a technology consultant in the oil and gas (XLE) and renewable energy industries. Another technology subsidiary of KBR is Weatherly, an Atlanta-based company operating in the fertilizer market. Finland-based Ecoplanning provides technology recovery solutions for weak acids, while Germany-based Plinke provides technology purification solutions for inorganic acids.

Service sector

KBR has three subsidiaries in the service sector: Technical Staffing Resources, KBR Training Solutions, and Mantenimiento Marino de Mexico. The latter two subsidiaries offer services mainly to the oil and industry.

Technical Staffing Resources is KBR’s staff-sourcing subsidiary, and Mantenimiento Marino de Mexico is KBR’s joint venture with Grupo R. It primarily offers maintenance to oil wells. Next, we’ll examine KBR’s business segments.