KBR Inc

Latest KBR Inc News and Updates

More about KBR’s Major Clients

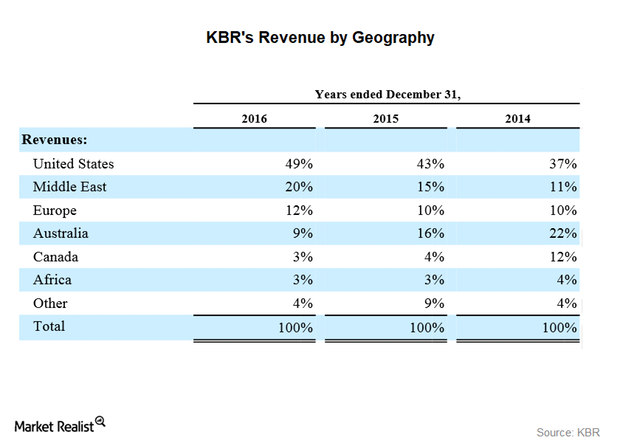

Clients and their sectors KBR (KBR) has a diverse customer base. According to KBR, its customers are “domestic and foreign governments, international and national oil and gas companies, independent refiners, petrochemical producers, fertilizer producers and manufacturers.” Revenue from overseas operations represented 63%, 57%, and 51% of KBR’s total revenue in 2014, 2015, and 2016, respectively. In this part, we’ll look at […]

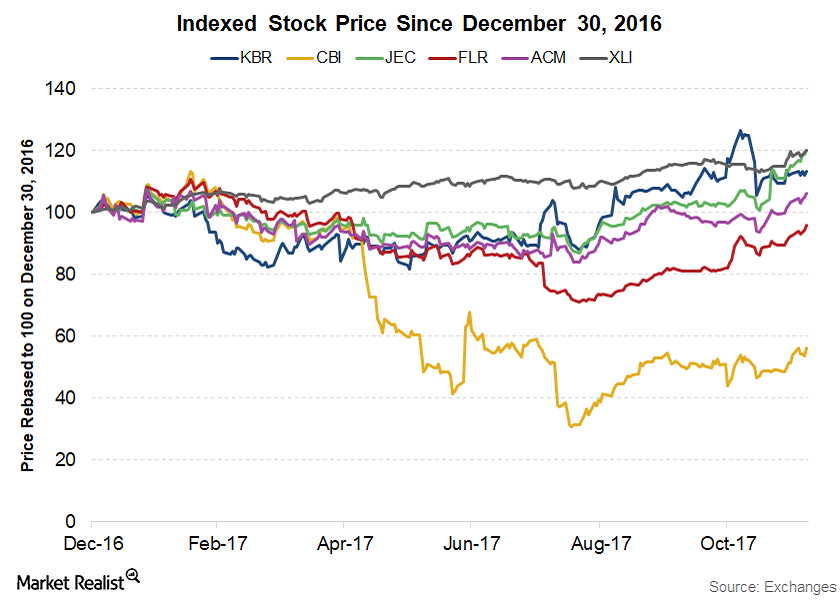

KBR Stock: Performance and Outlook

KBR has an assorted mix of business portfolios, which helps it combat cyclicality associated with any single market.

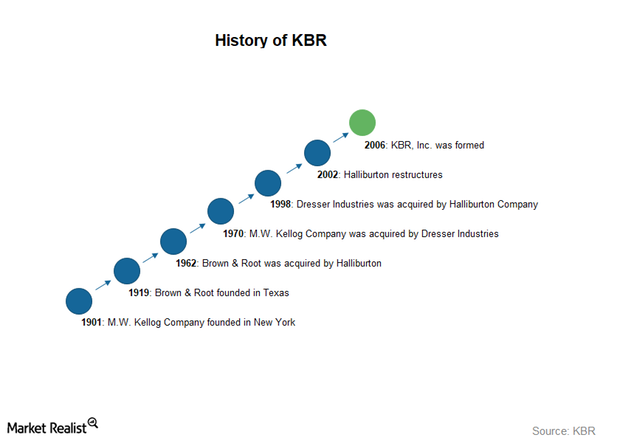

An Introduction to KBR

KBR (KBR), headquartered in Houston, Texas, is a comprehensive professional service and technology provider.

Understanding KBR’s Business Segments

Business segments KBR’s (KBR) business is classified into three core segments (government services, technology and consulting, and engineering and construction) and two non-core segments (non-strategic business and other business). Government services The government service segment’s primary focus is providing support solutions to US, UK, and Australian government agencies. According to KBR’s Form 10-K, the segment offers “full […]

A Look at KBR’s Subsidiaries

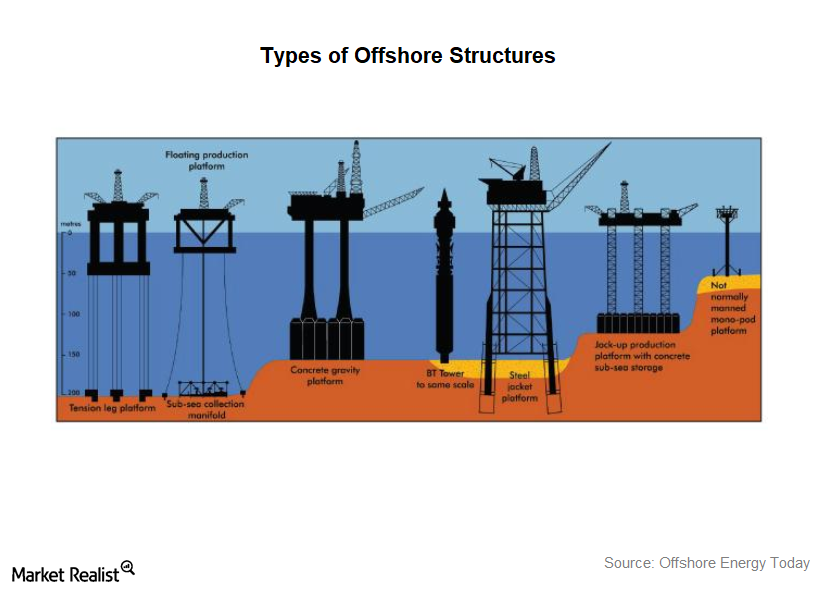

Primary subsidiaries Previously, we discussed various acquisitions completed by KBR (KBR). Let’s now take a look at some of KBR’s subsidiaries and how they fit into the big picture for the company. Energy and construction Granherne, a KBR technology and engineering subsidiary, operates in the oil and gas industry. Granherne provides front-end engineering and design services […]

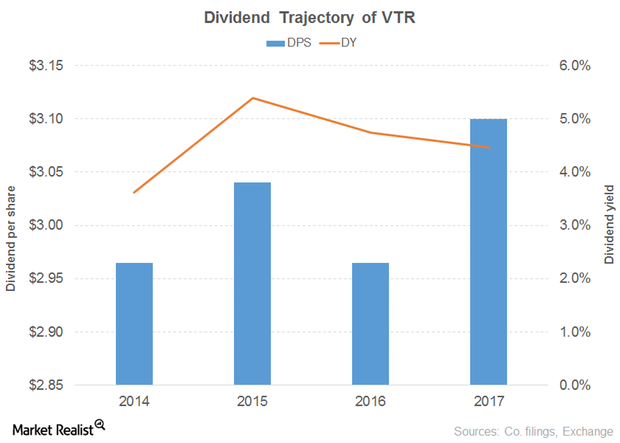

How Ventas’s Dividend Yield Compares

Revenue and earnings Ventas (VTR) is a major REIT in the United States and Canada. The company’s revenue growth slowed from 18% in 2015 to just 5% in 2016. The growth was driven by all of its segments, through resident fees and services, office building and other service revenue, and income from loans and investments, […]