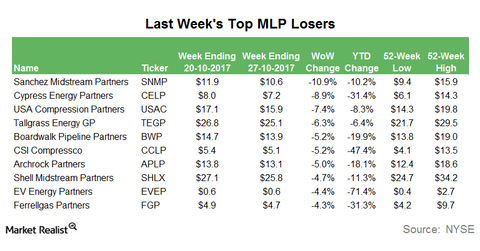

Last Week’s Biggest MLP Losers

Sanchez Production Partners (SNMP), the midstream MLP involved mainly in natural gas gathering, compression, and processing, was the biggest MLP loser last week.

Oct. 31 2017, Published 3:42 p.m. ET

Sanchez Production Partners

Sanchez Production Partners (SNMP), the midstream MLP involved mainly in natural gas gathering, compression, and processing, was the biggest MLP loser last week. SNMP fell 10.9% during the week. SNMP decline could be due to the continued weakness in Eagle Ford drilling activity. According to the recent rig report by Baker Hughes, natural gas rig counts in the Eagle Ford region fell to five by the end of the week, compared to eight by the end of the third quarter. At the same time, the total rig count in the region has come down to 65 from 68. SNMP, which has high exposure to the Eagle Ford region, is negatively impacted by a decline in Eagle Ford drilling activity.

Cypress Energy Partners

Cypress Energy Partners (CELP), the MLP mainly involved in saltwater disposal, other water-related midstream services, and pipeline inspection, was the second-biggest MLP loser last week. It fell 8.9% during the week. CELP’s recent weakness could also be due to the decline in drilling activity. The partnership has lost 31.4% in 2017 to date. Last week, CELP announced a flat distribution of $0.21 per unit for the third quarter of 2017.

USA Compression Partners

USA Compression Partners (USAC), the MLP mainly involved in natural gas compression, was the third-highest MLP loser last week. USAC fell 7.4% during the week. The demand for compression service is linked to the level of drilling activity and the recent fall in drilling activity could be the reason for the partnership’s fall last week. USAC is among the MLPs offering the highest distribution yields. For details, see USA Compression Partners Offers a 14% Yield: What Are the Risks?

Other MLP losers

Tallgrass Energy GP (TEGP), Boardwalk Pipeline Partners (BWP), CSI Compressco (CCLP), Archrock Partners (APLP), Shell Midstream Partners (SHLX), EV Energy Partners (EVEP), and Ferrellgas Partners (FGP) were among the top ten MLPs losers last week. In the next part of this series, we’ll look into last week’s top ten MLP gainers.