Most Analysts Recommend a ‘Hold’ on Harley-Davidson in March 2018

Harley-Davidson (HOG) maintained the highest US market share in the heavyweight motorcycle sector. Its stock underperformed other auto stocks in 2017 and lost ~12.8%.

March 30 2018, Updated 7:32 a.m. ET

Harley-Davidson

In 2017, iconic motorcycle manufacturer Harley-Davidson (HOG) maintained the highest US market share in the heavyweight motorcycle sector. However, the company’s stock underperformed other auto stocks last year and lost ~12.8%. In 2018 so far, HOG has lost about 17.4% through March 27.

The company’s weak 2017 global sales could be one of the key reasons for this dismal YTD (year-to-date) performance. In comparison, auto stocks (FXD) Honda (HMC), Tesla (TSLA), and Ford (F) have fallen 1.0%, 10.3%, and 12.3%, respectively, year-to-date.

Ratings on HOG

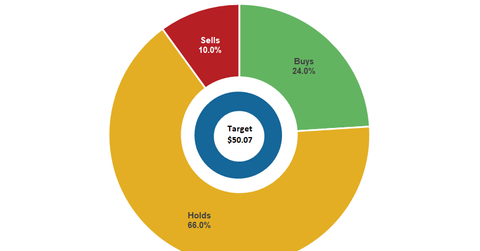

According to the latest data compiled by Reuters, 66.0% of analysts covering Harley-Davidson (HOG) stock gave it “hold” recommendations. Only 24.0% of these analysts recommended a “buy,” and the remaining 10.0% of these analysts gave HOG stock a “sell” recommendation.

On March 27, the analysts’ consensus target price for Harley-Davidson was $50.07 for the next 12 months. This price target reflected a 19.2% upside potential from its market price of $42.02. Analysts’ consensus target price for HOG stock has dropped in the last two months from $51.86 earlier.

Weakness could continue in 2018

In 4Q17, Harley-Davidson (HOG) reported a 74.1% YoY (year-over-year) increase in its adjusted earnings and beat analysts’ estimates by a narrow margin. The company’s 4Q17 global shipments fell ~9.6% YoY. However, its gross profit margin expanded slightly to 30.9% from 30.7% in 4Q16.

In 2018, the company plans to increase its focus on its international market sales to generate growth. During its 4Q17 earnings event, Harley-Davidson’s management told investors that its 2018 US sales could remain weak, which could be the primary reason for analysts’ caution on its stock.

Continue to the next part for a comparison of automakers’ valuation multiples as 1Q18 comes to an end.