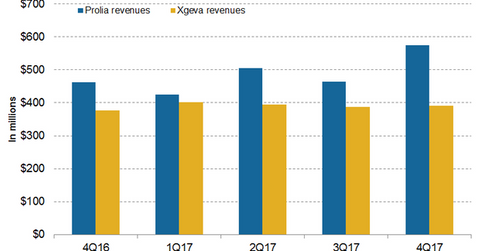

How Amgen’s Xgeva and Prolia Performed in 4Q17

In 4Q17, Xgeva generated revenues of $391 million, which reflected a 4% growth on a YoY (year-over-year) basis and a 1% growth quarter-over-quarter.

Feb. 9 2018, Updated 7:33 a.m. ET

Xgeva revenue trends

In 4Q17, Xgeva generated revenues of $391 million, which reflected a 4% growth on a YoY (year-over-year) basis and a 1% growth quarter-over-quarter. In 4Q17 in the US and international markets, Xgeva generated revenues of $285 million and $106 million, respectively.

Higher unit demand and favorable changes in inventory levels primarily contributed to revenue growth of Xgeva in 4Q17.

In fiscal 2017, Xgeva generated revenues of $1.6 billion, which reflected a 3% growth YoY. In 2017 in the US and international markets, Xgeva reported revenues of $1.2 billion and $418 million, respectively.

On January 5, 2018, Amgen’s supplemental Biologics License Application (or sBLA) for Xgeva received approval from the FDA (U.S. Food & Drug Administration) for expansion of the indication of the drug. With this approval, Xgeva can be indicated for the prevention of skeletal-related events (or SRE) in individuals with multiple myeloma. Xgeva received prior approval for the prevention of SRE in individuals with bone metastasis from solid tumors. To know more about Xgeva’s sBLA approval and the details of its Phase 3 clinical trial, which was the basis for FDA approval, please refer to Amgen’s Xgeva Could Witness Revenue Growth in 2018.

Prolia revenue trends

In 4Q17, Amgen’s (AMGN) Prolia generated revenues of $574 million, which reflected a 24% growth YoY and a 24% growth quarter-over-quarter. In 4Q17 in the US and international markets, Prolia generated revenues of $369 million and $205 million, respectively.

In fiscal 2017, Prolia reported revenues of $2 billion, which reflected a 20% growth YoY. In 2017 in the US and international markets, Prolia generated revenues of $1.3 billion and $696 million, respectively. Higher unit demand primarily contributed to Prolia’s revenue growth in 2017.

Prolia (denosumab) is used for the treatment of post-menopausal women with osteoporosis who are at a high risk of fracture. Prolia is also used to increase bone mass in men with osteoporosis who are at increased risk of fracture. In the osteoporosis market, Prolia competes with Merck’s (MRK) Fosamax, Novartis’s (NVS) Reclast (zoledronic acid), and Eli Lilly’s (LLY) Forteo (teriparatide).