What Analysts Expect from Frontier’s 3Q17 Earnings

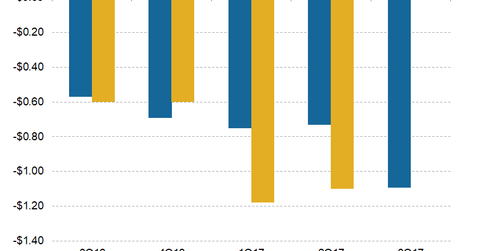

Frontier Communications (FTR) will publish its 3Q17 results on October 31, 2017. Analysts expect Frontier’s EPS (earnings per share) to fall $1.09 in 3Q17.

Oct. 31 2017, Published 8:53 a.m. ET

Frontier’s earnings in 3Q17

Frontier Communications (FTR) will publish its 3Q17 results on October 31, 2017. In this series, we’ll take a look at the expectations for the telecommunication company’s performance during the quarter. Wall Street analysts expect Frontier’s EPS (earnings per share) to fall $1.09 in 3Q17.

In 2Q17, Frontier reported an adjusted EPS loss of $1.10 and missed analysts’ consensus estimate of a loss of $0.73. Its net loss increased to $662 million compared to a net loss of $75 million in 1Q17. The sharp spike in net loss was driven by a goodwill impairment charge of $532 million.

Despite the procurement of Verizon’s (VZ) wireline assets, Frontier could face an execution risk, given the size of the acquisition and integration uncertainties. However, the company continues to foresee an operational improvement in the acquired business going forward.