Windstream Holdings, Inc.

Latest Windstream Holdings, Inc. News and Updates

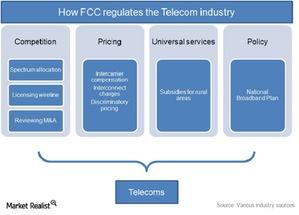

Investors should be aware of regulations in the telecom industry

In the US and around the world, the telecom industry is regulated because market forces can’t maintain competition within the highly capital-intensive industry.

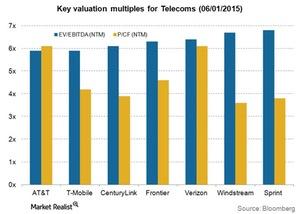

Valuation metrics that investors can use in the telecom industry

Investors often use different metrics to determine telecom companies’ relative valuation. Telecom is a capital-intensive industry with high fixed costs.

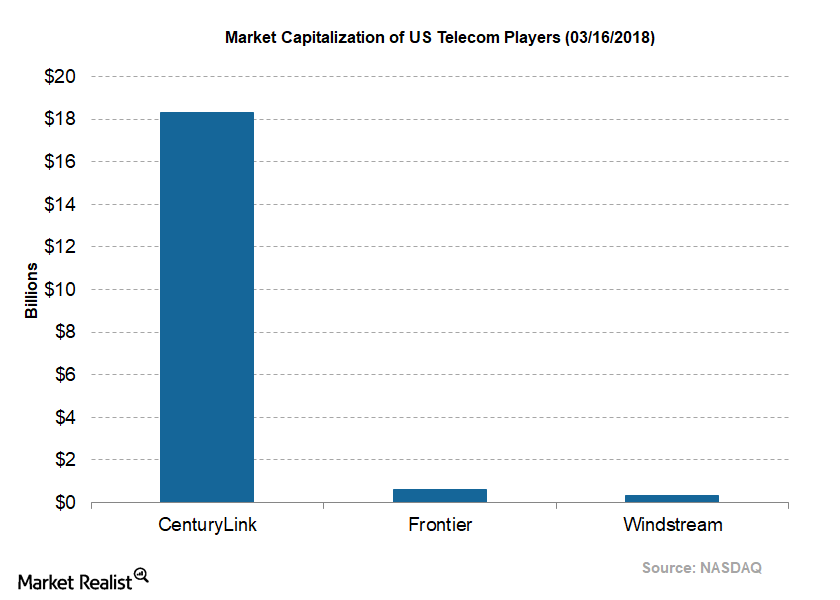

How CenturyLink’s Valuation Compares

As of March 16, 2018, AT&T (T) was the largest US telecom player, with a market capitalization of ~$227.2 billion.

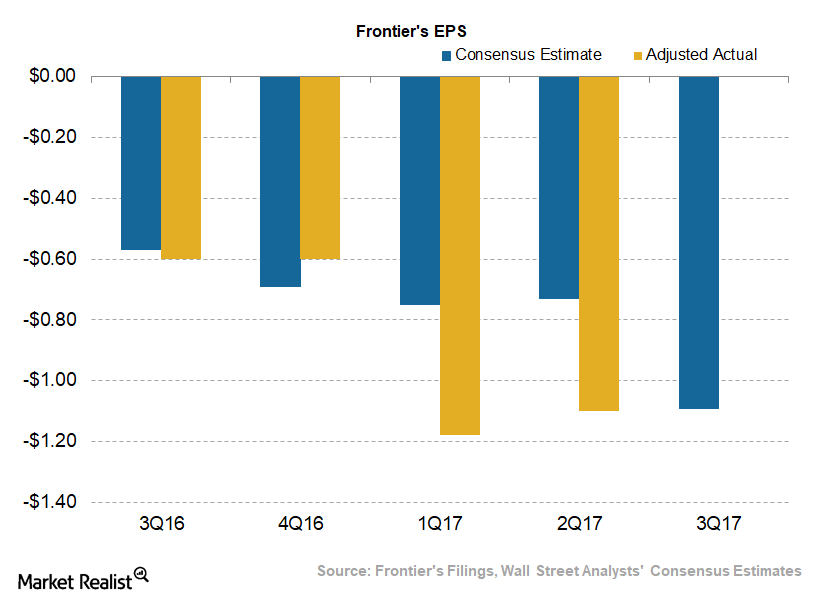

What Analysts Expect from Frontier’s 3Q17 Earnings

Frontier Communications (FTR) will publish its 3Q17 results on October 31, 2017. Analysts expect Frontier’s EPS (earnings per share) to fall $1.09 in 3Q17.

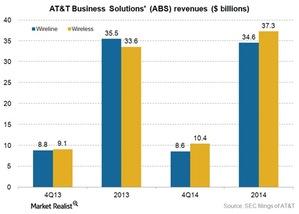

Why AT&T Business Solutions shifts focus to wireless customers

AT&T plans to focus more on business customers in 2015. The company’s Business Solutions segment caters primarily to enterprises, government, wholesale customers, and carriers.

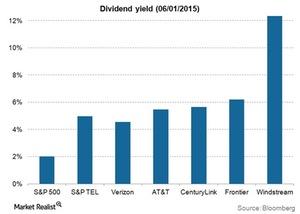

What kind of investors might like the telecom industry?

Telecom is a defensive industry. Investors looking for high dividend yield in a low-interest rate environment may like the telecom industry.

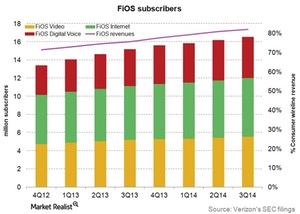

Analyzing the wireline telecom network and its evolving structure

A wireline network includes interlinked connection and redistribution systems. The network allows information—like voice and data—to travel electronically.