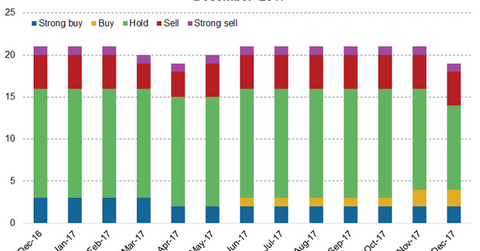

Valeant on the Street: Analyst Recommendations in December 2017

Of the 19 analysts tracking Valeant Pharmaceuticals in December 2017, two recommended a “strong buy,” while another two of recommended a “buy.”

Jan. 9 2018, Updated 10:31 a.m. ET

Recent developments

In December 2017, Valeant Pharmaceuticals’ (VRX) subsidiary Bausch + Lomb announced that the company has started distributing Vyzulta (latanoprostene bunod ophthalmic solution) to US wholesale pharmaceutical distributors.

In November 2017, the FDA (US Food and Drug Administration) approved Vyzulta for decreasing the intraocular pressure in individuals with open-angle glaucoma or ocular hypertension.

Vyzulta is expected to strengthen Bausch + Lomb’s product portfolio as well as boost revenue growth. Notably, the Vanguard Total International Stock ETF (VXUS) invests ~0.03% of its total portfolio holdings in Valeant Pharmaceuticals.

Analyst recommendations

Of the 19 analysts tracking Valeant Pharmaceuticals in December 2017, two recommended a “strong buy,” while another two of recommended a “buy.” Ten analysts recommended a “hold,” while four recommended a “sell,” and one suggested a “strong sell.”

On December 27, 2017, Valeant had a consensus 12-month target price of $16.44, which represents a 24% decline over the next 12 months. Notably, the Pharmaceutical ETF (PPH) invests ~5.43% of its total portfolio holdings in Valeant Pharmaceuticals.

Peer ratings

Of the 28 analysts tracking Teva Pharmaceuticals (TEVA) in December 2017, only one suggested a “strong buy,” while four recommended a “buy.” Nineteen analysts recommended a “hold,” while four recommended a “sell.”

On December 27, 2017, Teva Pharmaceuticals had a consensus 12-month target price of $18.3, which represents a 3.1% decline over the next 12 months.

Of the four analysts tracking Novartis (NVS) in December 2017, only one analyst recommended a “strong buy,” while one recommended a “buy,” one recommended a “hold,” and one recommended a “sell.” On December 27, 2017, Novartis had a consensus 12-month target price of $93, which represents a ~10.9% return on investment over the next 12 months.

Of the 29 analysts tracking Gilead Sciences (GILD) in December 2017, three recommended a “strong buy” while 11 and 15 analysts recommended “buy” and “hold” ratings, respectively.

On December 27, 2017, Gilead Sciences had a consensus 12-month target price of $85.61, which represents a 17.3% return on investment over the next 12 months.