Analyzing European Markets in the Morning Session on January 17

At 4:55 AM EST on January 17, the DAX Index was trading at 13,224.50—a drop of 0.16%. The iShares MSCI Germany (EWG) rose 0.14% on January 16.

Jan. 18 2018, Updated 7:32 a.m. ET

United Kingdom

After gaining for six consecutive trading weeks and reaching record high levels, the United Kingdom’s FTSE 100 Index lost strength this week. The FTSE 100 Index fell in the first two trading days this week and opened the day lower on Wednesday. In the early hours, the FTSE 100 Index is trading with weakness below opening prices at one-week low price levels.

Market sentiment

The market sentiment in European markets was strong last week amid the release of supporting economic data and the improved global risk appetite. The market opened lower today following weakness in US markets and mixed sentiment in Asia. The release of disappointing corporate updates from companies like Burberry Group is weighing on the market. The disappointing forecast for the United Kingdom’s December retail sales data and Burberry Group’s lower quarterly sales data weighed on the retail sector on Tuesday.

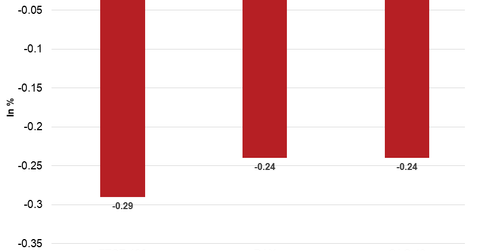

The market is looking forward to the release of December’s U.K. RICS House Price Balance data at 7:01 PM EST today. At 4:50 AM EST today, the FTSE 100 Index was trading at 7,735.25—a drop of 0.27%. The iShares MSCI United Kingdom (EWU) fell 0.13% on January 16.

Germany

After starting this week on a weaker note by falling to ten-day low price levels on Monday, Germany’s DAX Index tried to move higher on Tuesday. The DAX Index rose in the morning session on Tuesday. However, it reversed and closed the day with limited losses. On Wednesday, the market opened lower following weakness in US markets and traded above opening prices with mixed sentiment in the morning session.

At 4:55 AM EST on January 17, the DAX Index was trading at 13,224.50—a drop of 0.16%. The iShares MSCI Germany (EWG) rose 0.14% on January 16.

France

Following a strong performance for two weeks, France’s CAC 40 Index started this week on a mixed note and consolidated in the first two trading days. On Wednesday, the CAC 40 Index opened lower and traded with mixed sentiment above the opening prices in the morning session. At 5:10 AM EST today, the CAC 40 Index was trading at 5,499.50—a drop of 0.26%. The iShares MSCI France (EWQ) rose 0.27% on January 16.

Next, we’ll discuss how US Treasury yields and the US dollar performed in the early hours on Wednesday.