CAC 40

Latest CAC 40 News and Updates

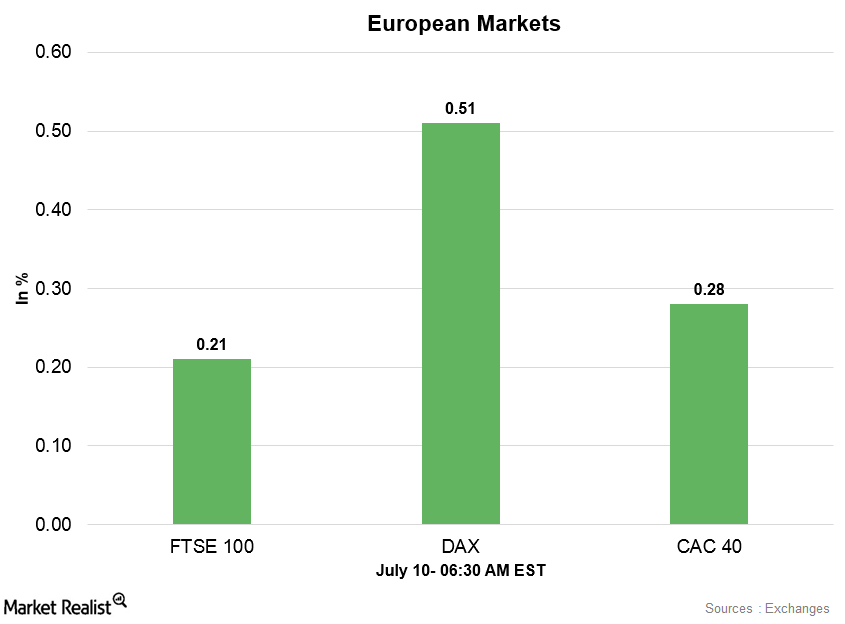

European Markets Opened Higher amid Improved Global Sentiment

France’s CAC 40 Index quit falling last week and traded in a range of 5,200–5,100. This week, it opened higher amid improved global sentiment.

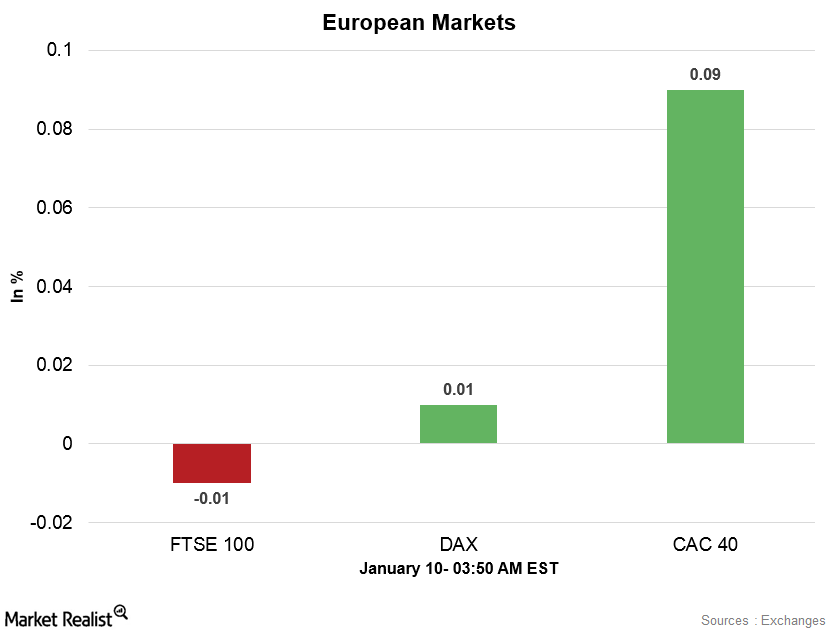

European Markets Are Mixed Early on January 11

At 3:45 AM EST on January 11, the DAX Index was trading at 13,275.50—a fall of 0.04%. The iShares MSCI Germany (EWG) fell 0.88% on January 10.

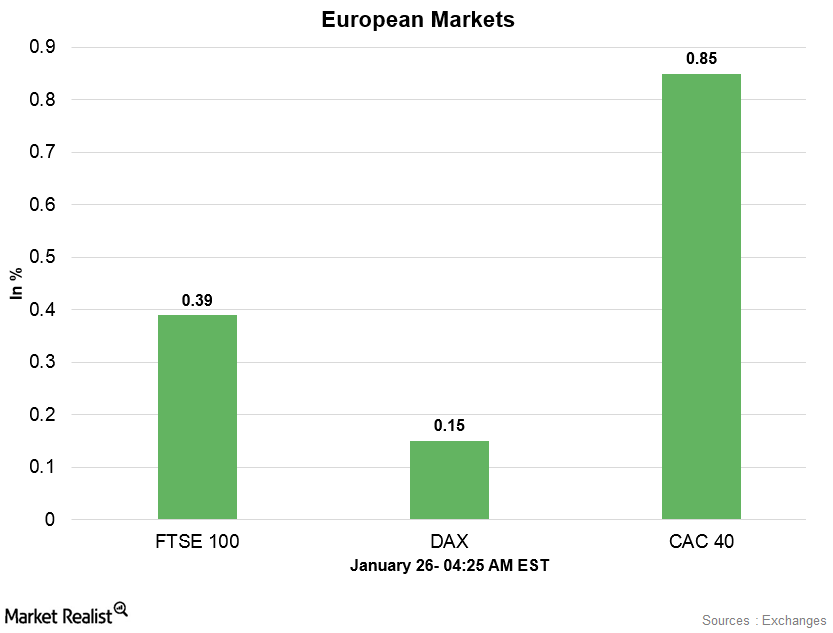

European Markets Are Mixed in the Morning Session on January 26

At 4:25 AM EST on January 26, the DAX Index was trading at 13,306.50—a gain of 0.06%. The iShares MSCI Germany (EWG) fell 0.7% on January 25.

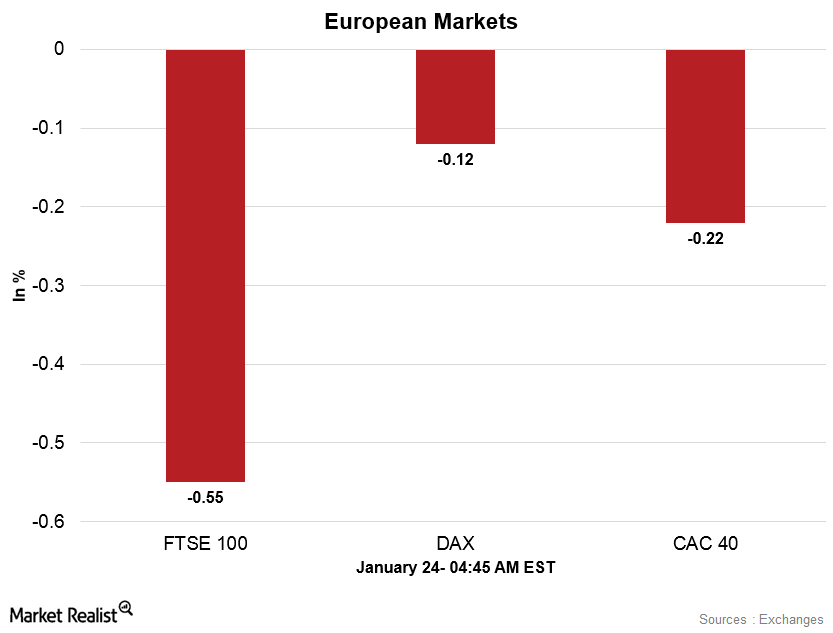

Analyzing European Markets Early on January 24

At 4:40 AM EST on January 24, the DAX Index was trading at 13,536.50—a fall of 0.17%. The iShares MSCI Germany (EWG) rose 0.54% on January 23.

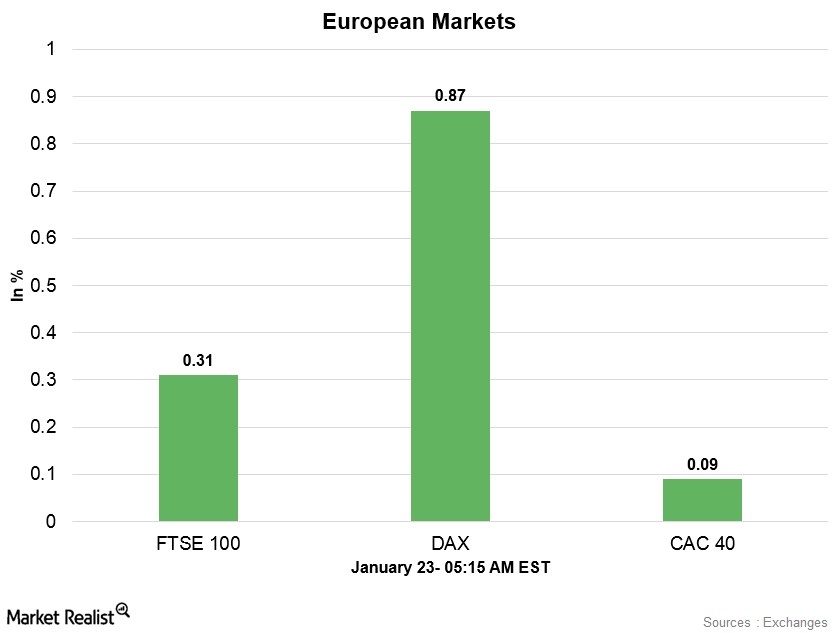

European Markets Were Stronger Early on January 23

At 5:05 AM EST on January 23, the DAX Index was trading at 13,574.50—a rise of 0.82%. The iShares MSCI Germany (EWG) rose 0.62% on January 22.

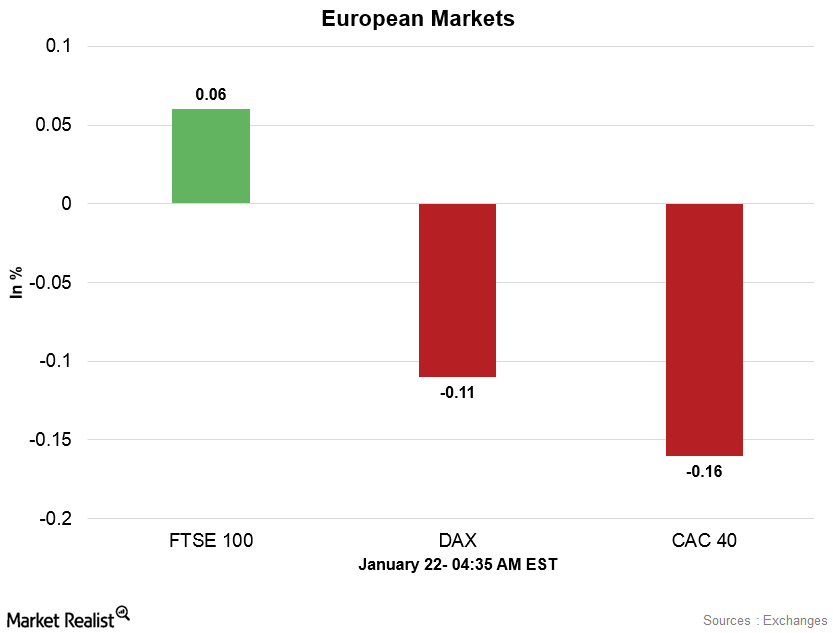

European Markets in the Morning Session on January 22

At 4:30 AM EST on January 22, the DAX Index was trading at 13,419.50—a fall of 0.1%. The iShares MSCI Germany (EWG) rose 1.1% on January 19.

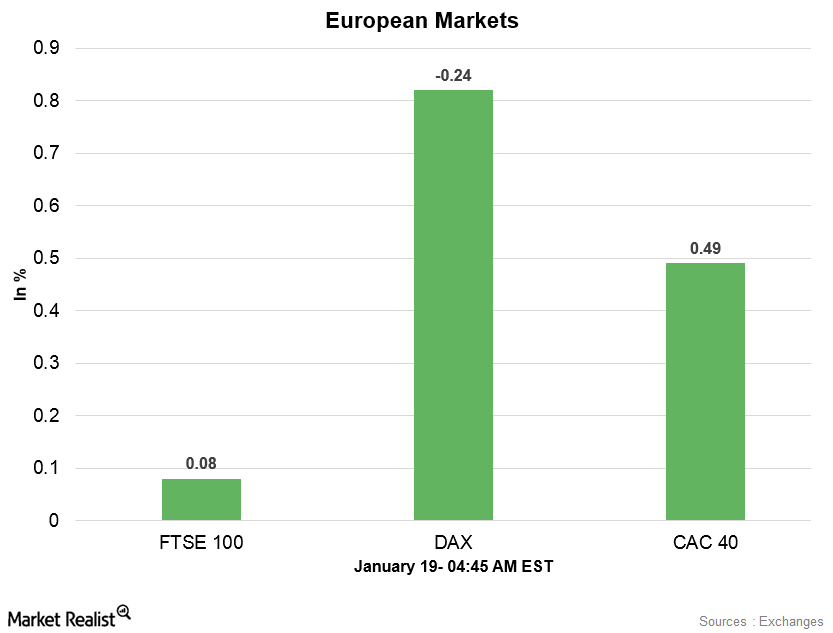

European Markets Are Strong Early on January 19

At 4:45 AM EST on January 19, the DAX Index was trading at 13,387.50—a gain of 0.8%. The iShares MSCI Germany (EWG) rose 0.58% on January 18.

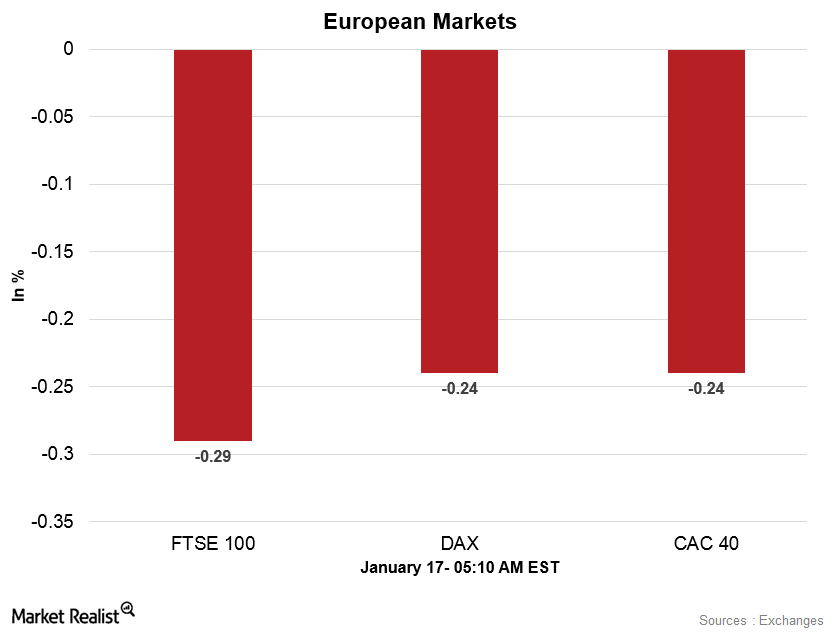

Analyzing European Markets in the Morning Session on January 17

At 4:55 AM EST on January 17, the DAX Index was trading at 13,224.50—a drop of 0.16%. The iShares MSCI Germany (EWG) rose 0.14% on January 16.

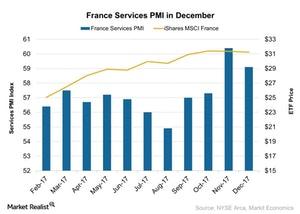

How Did France’s Services PMI Look in December 2017?

According to the data provided by Markit Economics, the final Markit France services PMI (purchasing managers’ index) fell marginally in December as compared to the previous month.