How Do Miners’ Technical Details Look?

Most of the mining companies have risen during the past few weeks. The miners tend to move according to precious metal prices rather than the equities market in general.

Jan. 10 2018, Updated 10:00 a.m. ET

Mining stocks in 2018

Most of the mining companies have risen during the past few weeks. Miners tend to move according to precious metal prices rather than the equities market in general. For our analysis here, we’ve selected Pan American Silver (PAAS), Cia De Minas Buenaventura (BVN), Kinross Gold (KGC), and Harmony Gold (HMY). These four miners have a 30-day trailing loss of 5.8%, 9.9%, 11.9%, and 3.3%, respectively. The past few weeks have been very good for miners, as precious metals have rebounded.

Volatility analysis

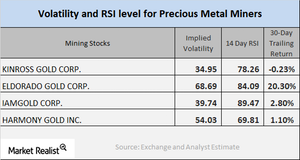

The call implied volatility of miners is essential, as it gives us the price changes in the miners that occurred due to the variations in its call price. PAAS, BVN, KGC, and HMY have call implied volatilities of 29.6%, 31.6%, 36.6%, and 53.2%, respectively.

RSI readings

When a stock’s RSI level is greater than 70, it indicates that it could be in overbought territory, and so the stock’s price could fall. When a stock’s RSI indicator is less than 30, however, it indicates that the stock could be oversold, so its price could rise. PAAS, BVN, KGC, and HMY have RSI levels of 60.9, 84.3, 88.3, and 69.2, respectively.

The Sprott Gold Miners (SGDM) and the MSCI Global Gold Min (RING) have risen 2.7% and 3.4%, respectively, on a five-day trailing basis as of January 4. Movements in precious metals are crucial to these mining-based funds.