What Happened with Interactive Brokers’ Market-Making Business

Loss witnessed Interactive Brokers Group’s (IBKR) market-making business saw pre-tax income of -$35 million in the first three quarters of 2017, compared with $32 million in the same period of the prior year, primarily due to lower net revenue. Whereas the division’s trading gains fell from $124 million to $26 million, its other income rose to $14 […]

Dec. 19 2017, Updated 10:31 a.m. ET

Loss witnessed

Interactive Brokers Group’s (IBKR) market-making business saw pre-tax income of -$35 million in the first three quarters of 2017, compared with $32 million in the same period of the prior year, primarily due to lower net revenue. Whereas the division’s trading gains fell from $124 million to $26 million, its other income rose to $14 million from $4 million.

Non-interest expenses

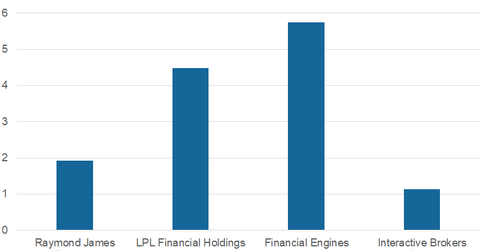

The market-making division’s non-interest expenses fell to $96 million in the first three quarters of 2017 from $113 million in the same period of the prior year, primarily due to lower execution and clearing expenses as a result of lower trading volumes. Employee compensation and benefits expenses fell to $20 million from $23 million, reflecting reduced staff, and communication expenses fell to $6 million from $8 million. Whereas Interactive Brokers Group’s last-12-month return on assets is 1.1%, peers (XLF) Raymond James Financial (RJF), LPL Financial Holdings (LPLA), and Financial Engines (FNGN) have returned 1.9%, 4.5%, and 5.8%, respectively.