Financial Engines Inc

Latest Financial Engines Inc News and Updates

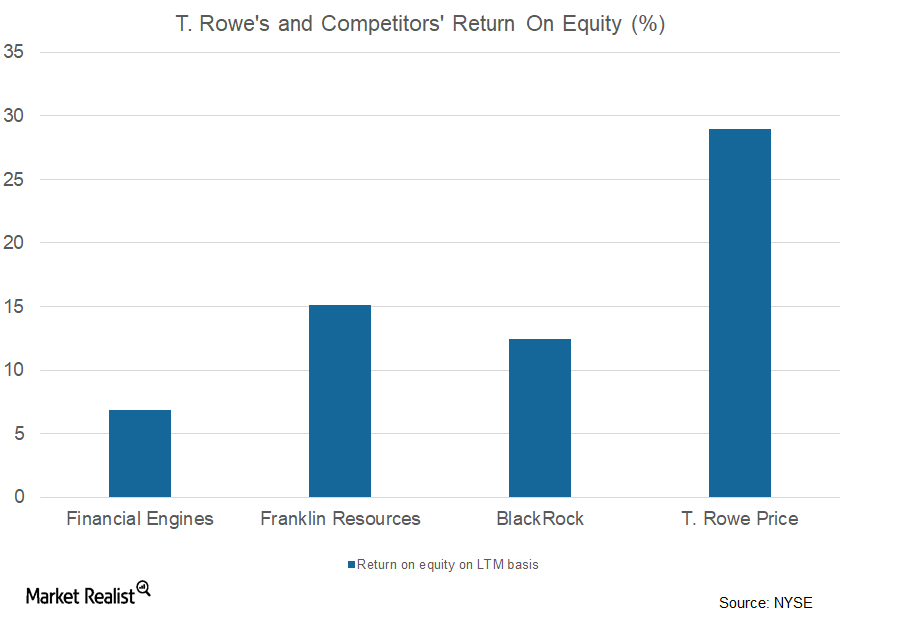

A Look at T. Rowe Price’s Assets under Management

Asset classes In its investor presentation on February 21, 2018, T. Rowe Price (TROW) stated that its core business is helped by the allocation of its AUM (assets under management) in different asset classes and its strong client base. However, the company also believes that targeting new opportunities is crucial for its core business. Of its total AUM, […]

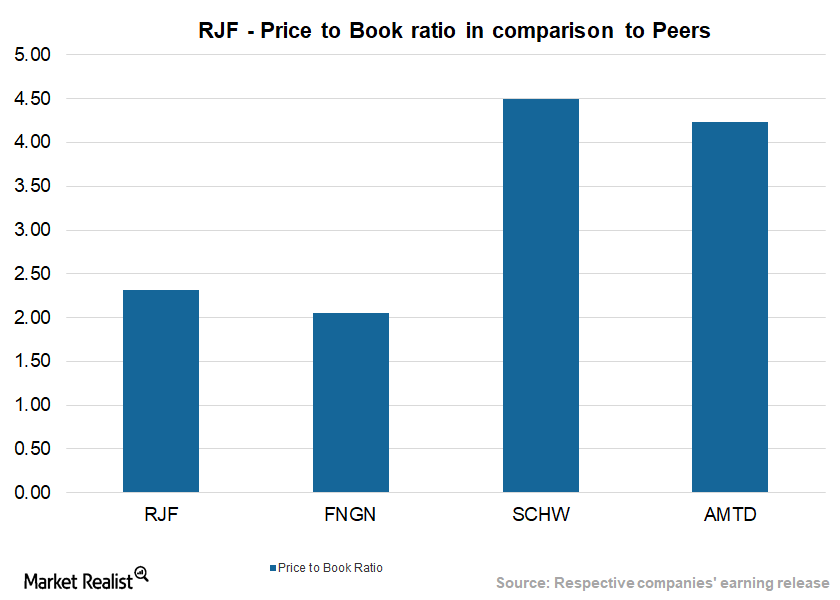

Raymond James Financial Compared to Its Peers

Raymond James Financial (RJF) generated a return of 4.8% in the last three months and 17.6% in the last year.

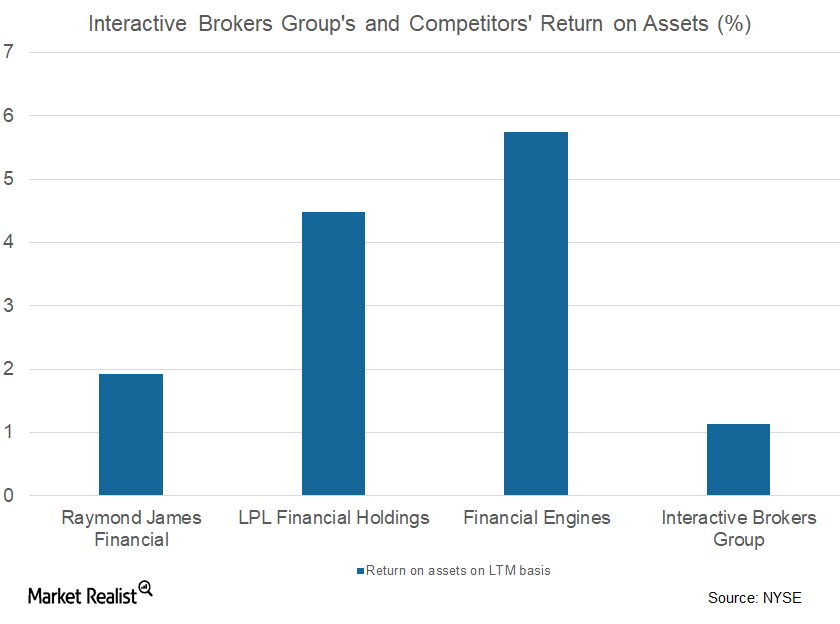

What Happened with Interactive Brokers’ Market-Making Business

Loss witnessed Interactive Brokers Group’s (IBKR) market-making business saw pre-tax income of -$35 million in the first three quarters of 2017, compared with $32 million in the same period of the prior year, primarily due to lower net revenue. Whereas the division’s trading gains fell from $124 million to $26 million, its other income rose to $14 […]