LPL Financial Holdings Inc

Latest LPL Financial Holdings Inc News and Updates

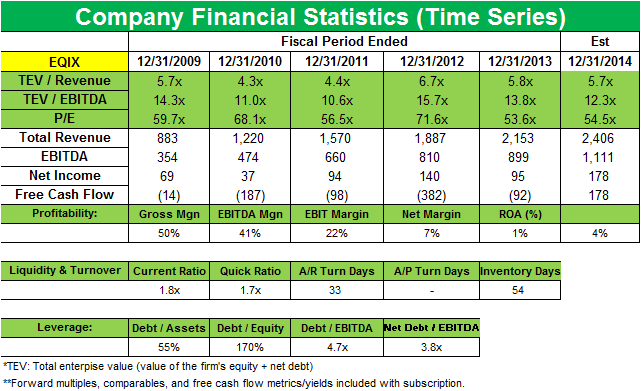

Stephen Mandel’s Lone Pine Capital buys a new position in Equinix

Lone Pine initiated a new position in Equinix (EQIX) last quarter that accounts for 1.81% of the fund’s total 1Q portfolio. Lone Pine had exited the position in 4Q 2013 and restarted it last quarter.

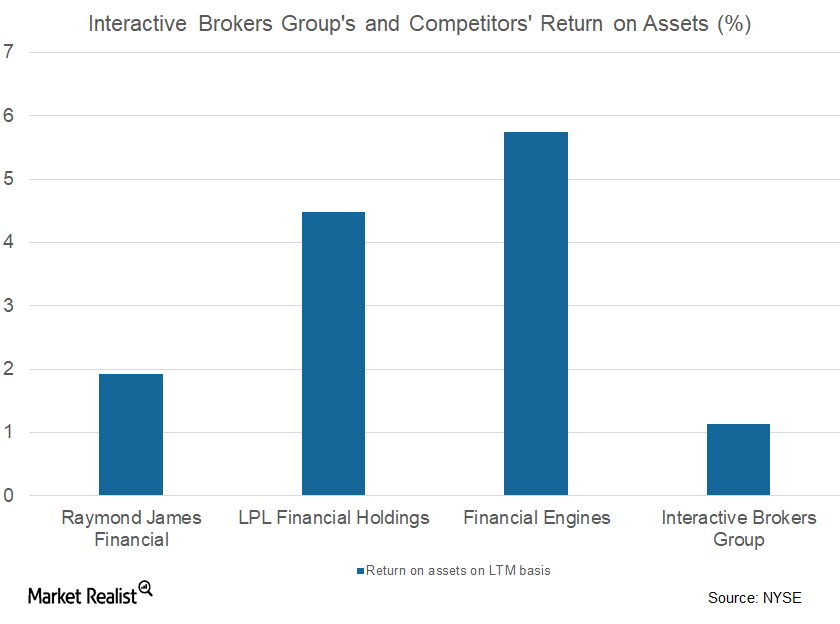

What Happened with Interactive Brokers’ Market-Making Business

Loss witnessed Interactive Brokers Group’s (IBKR) market-making business saw pre-tax income of -$35 million in the first three quarters of 2017, compared with $32 million in the same period of the prior year, primarily due to lower net revenue. Whereas the division’s trading gains fell from $124 million to $26 million, its other income rose to $14 […]