Raymond James Financial Inc

Latest Raymond James Financial Inc News and Updates

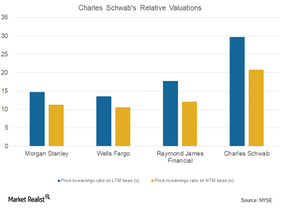

What’s Charles Schwab’s Valuation?

Charles Schwab (SCHW) has a price-to-earnings ratio of 20.80x on an NTM (next-12-month) basis.

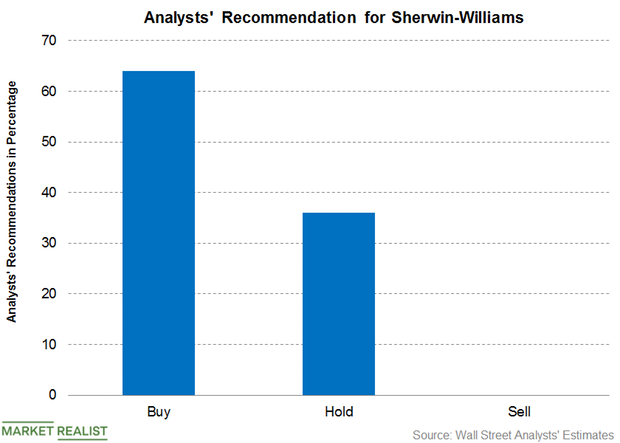

Sherwin-Williams: Analysts’ Recommendations

For Sherwin-Williams, 64% of the analysts recommended a “buy,” 36% recommended a “hold,” and none of the analysts recommended a “sell.”

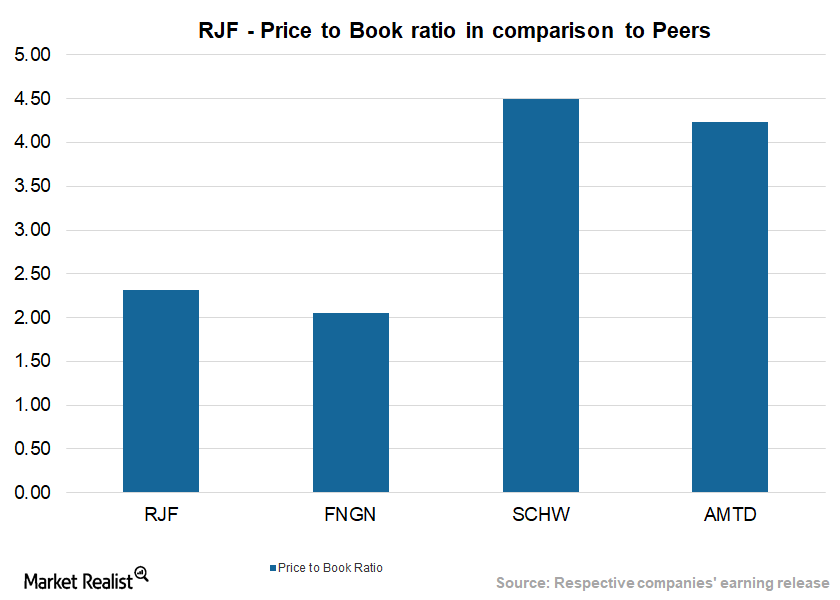

Raymond James Financial Compared to Its Peers

Raymond James Financial (RJF) generated a return of 4.8% in the last three months and 17.6% in the last year.

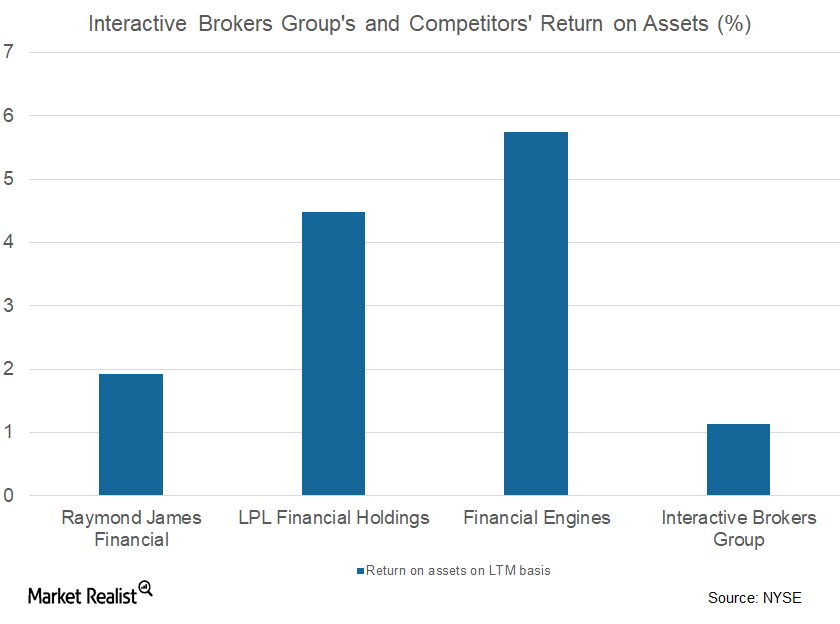

What Happened with Interactive Brokers’ Market-Making Business

Loss witnessed Interactive Brokers Group’s (IBKR) market-making business saw pre-tax income of -$35 million in the first three quarters of 2017, compared with $32 million in the same period of the prior year, primarily due to lower net revenue. Whereas the division’s trading gains fell from $124 million to $26 million, its other income rose to $14 […]