Are the Gains in Natural Gas and Oil Coincidental?

Between January 9 and January 16, 2018, the correlation between natural gas and US crude oil active futures was 52.7%.

Jan. 17 2018, Updated 4:00 p.m. ET

Correlations

Between January 9 and January 16, 2018, the correlation between natural gas (GASL) (GASX) (FCG) and US crude oil (OIIL) (USL) (DBO) active futures was 52.7%. Over that period, US crude oil rose 1.2% compared to a 7% rise in natural gas futures.

Energy commodities

On January 16, 2018, natural gas and oil prices fell 2.2% and 0.9%, respectively. In Part 1 of this series, we looked at the factors that pulled down natural gas prices. For US crude oil prices, the EIA’s (U.S. Energy Information Administration) inventory data on January 18, 2018, could be crucial apart from the OPEC (Organization of the Petroleum Exporting Countries) Monthly Oil Market Report. Similarly, the EIA’s natural gas inventory data will impact natural gas prices on the same day.

One-month correlation

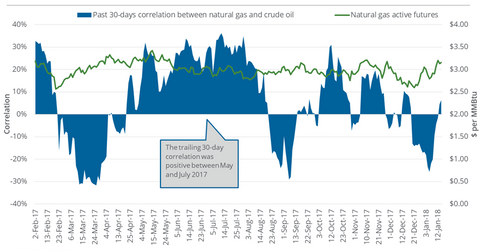

On January 16, 2018, natural gas and US crude oil’s last 30-day correlation was 6.4%. In the last 30 trading sessions, natural gas futures rose 7.1%, and US crude oil prices rose 13.9%.

Between May and July 2017, the last 30-day correlation was 30% at times. There could be a direct relationship between the two energy commodities over a long term. Natural gas can sometimes track oil prices due to non-fundamental factors such as market sentiment.

However, individual fundamental factors related to either commodity can dominate non-fundamental factors. For example, the weather is an important factor for natural gas prices during the winter.