Does Southern Company Stock Have an Attractive Valuation?

Southern Company (SO), the second largest rate-regulated utility, is currently trading at an EV-to-EBITDA multiple of 10.5x.

Jan. 12 2018, Updated 4:20 p.m. ET

Valuation

Southern Company (SO), the second largest rate-regulated utility, is currently trading at an EV-to-EBITDA multiple of 10.5x. Its five-year historical valuation average is near 11.0x, while broader utilities are currently trading at an average valuation multiple of 10.5x. Thus, SO stock looks to be trading at an attractive valuation compared to its historical average as well as the industry average.

Southern Company stock is among the very few S&P 500 utilities that are trading at an attractive valuation. The steep fall in Southern Company stock recently might present aggressive investors with an opportunity to enter.

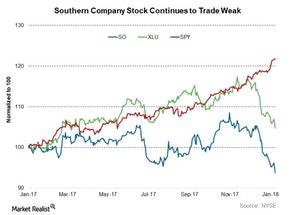

The chart above shows the normalized stock price movements of Southern Company along with broader markets (SPX-INDEX) (SPY) and peer utilities (XLU) (VPU).

Southern Company stock underperformed peers by a huge margin last year. SO fell 7%, while the Utilities Select Sector SPDR ETF (XLU), which tracks the S&P 500 Utilities Index, managed to gain 4% in the last one year. In comparison, broader markets rose 20% in the same period.